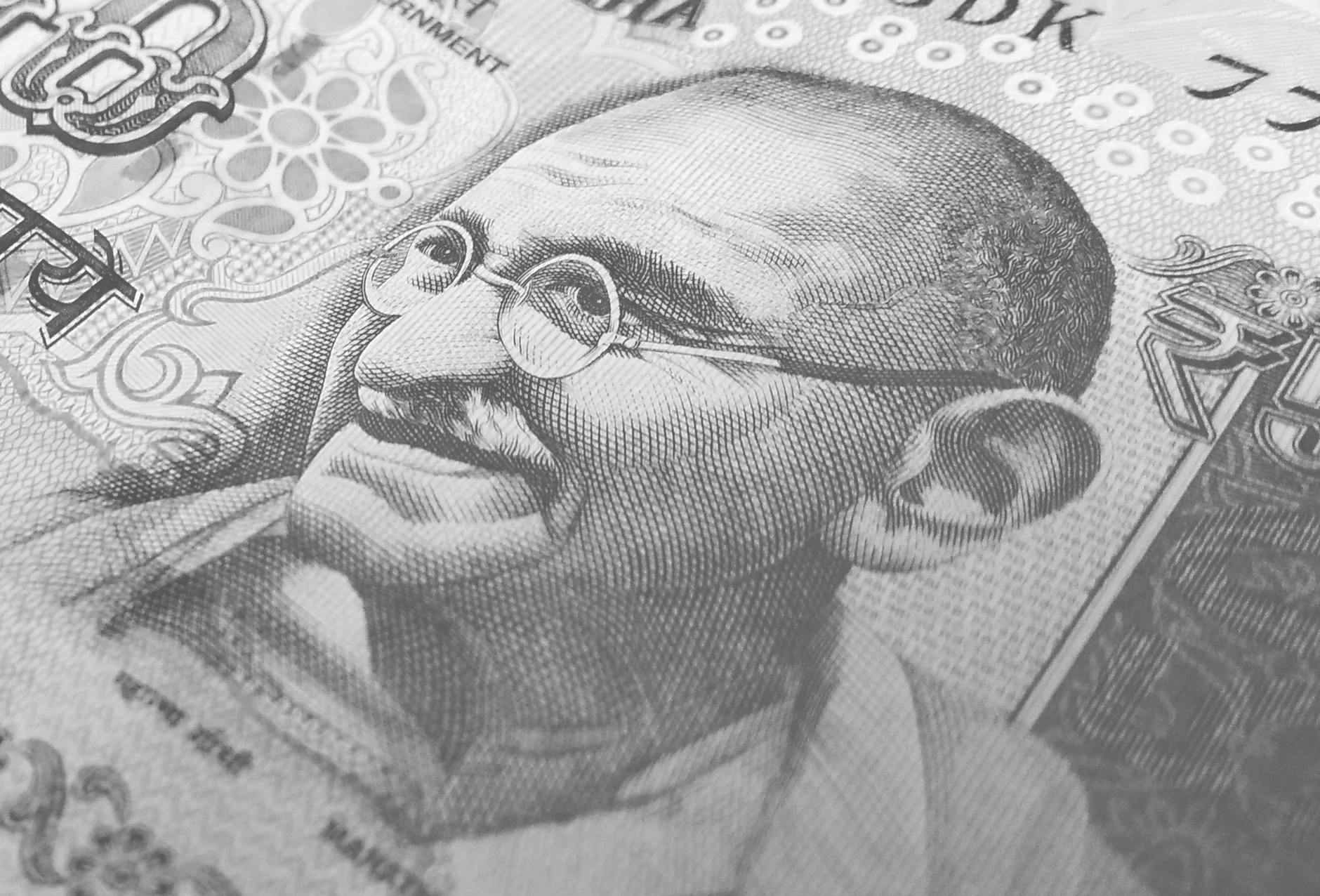

India’s August Economic Report highlights several key trends that shape the current economic outlook. The report suggests that public expenditure is expected to pick up in the remaining months of the fiscal year, providing a boost to growth and investment. However, uneven rainfall in certain regions could affect farm output, which may impact rural income and agricultural production.

In the absence of major climate shocks, rural incomes and demand are likely to strengthen, which could lead to milder food inflation. Lower global oil prices are seen as a positive factor for the Indian economy, helping to contain inflation and support economic stability. The inflation trajectory outlook remains optimistic, driven by improved supply chains and lower input costs.

The labor market continues to show signs of improvement, with more job opportunities emerging across various sectors. However, urban consumption displays some signs of weakness, possibly due to slowing demand in certain industries. Businesses are also facing challenges in the form of high transportation costs, which is one of the main factors hindering their ability to expand exports.

Overall, the report paints a mixed picture of the Indian economy, with positive developments in rural areas and inflation control, but challenges remain in urban consumption and export expansion.

India plans to borrow a total of 6.61 trillion rupees through bond sales during the October to March period, according to an official statement. This includes the sale of 200 billion rupees worth of green bonds. Additionally, the government has set a Ways and Means Advances (WMA) limit of 500 billion rupees for the second half of the fiscal year.

In the third quarter (Q3), the Indian government plans to borrow 190 billion rupees each week through Treasury Bill issuances over a span of 13 weeks. Additionally, they aim to sell 2.47 trillion rupees worth of Treasury Bills during the October to December period. To manage debt repayments efficiently, the government will undertake security switching and buyback operations, ensuring a smooth repayment process.

The government also intends to sell 100 billion rupees each of 10-year and 30-year green bonds between October and March, as part of its green financing initiatives.

According to the Secretary of Economic Affairs, Treasury Bill borrowings have been reduced, taking into account the current levels of government holdings and projected cash flows. Furthermore, to handle the repayment of borrowings from the two pandemic years, the government will make necessary adjustments in long-term borrowings to ensure a smoother redemption profile going forward.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment