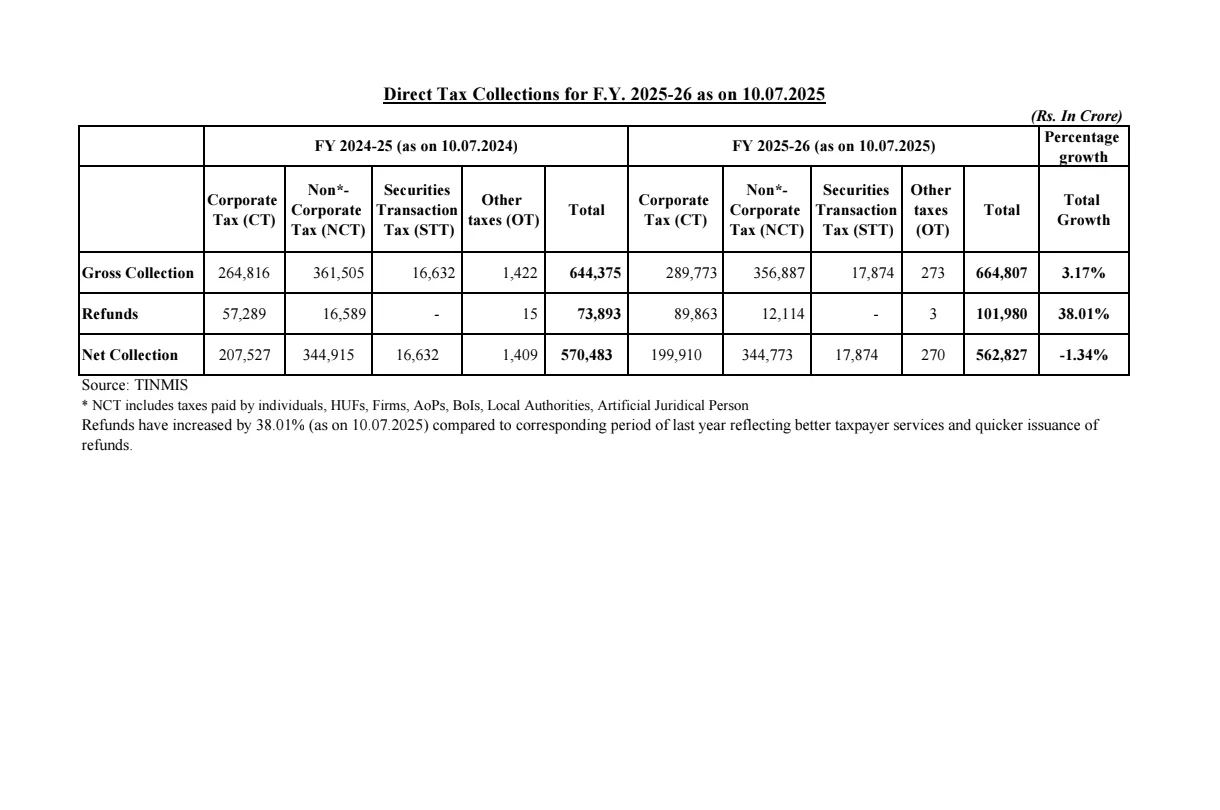

India’s net direct tax collection for the current financial year (FY 2025–26), as of July 10, 2025, stood at Rs 562,827 lakh crore. This shows a 1.34% decline compared to the same period last year, when the net collection was Rs 570,483 lakh crore, according to the latest data from the Central Board of Direct Taxes (CBDT).

Corporate Tax Drops, Personal Tax Remains Stable

The main reason behind the fall in net collection is a decline in corporate tax receipts.

Corporate tax collection fell by 3.81%, from Rs 207,527 lakh crore in FY25 to Rs 199,910 lakh crore in FY26.

Meanwhile, non-corporate tax collection, which includes personal income tax, stayed mostly unchanged at Rs 344,773 lakh crore.

Gross Collection Sees Small Rise

Gross direct tax collection rose by 3.17% year-on-year, reaching Rs 664,375 lakh crore, compared to Rs 644,375 lakh crore in the same period last year.

Refunds Surge 38%, Dragging Down Net Collection

A big reason for the lower net tax figure is the sharp rise in tax refunds.

Refunds issued so far in FY26 stood at Rs 101,980 lakh crore, up 38% from Rs 73,893 crore in FY25.

This higher refund outflow has reduced the net tax collected, even though gross tax collections have increased.

What This Means for the Government

These early numbers highlight the initial trend in tax revenue collection for FY26. With the government targeting fiscal consolidation, these trends will be watched closely in the coming months.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment