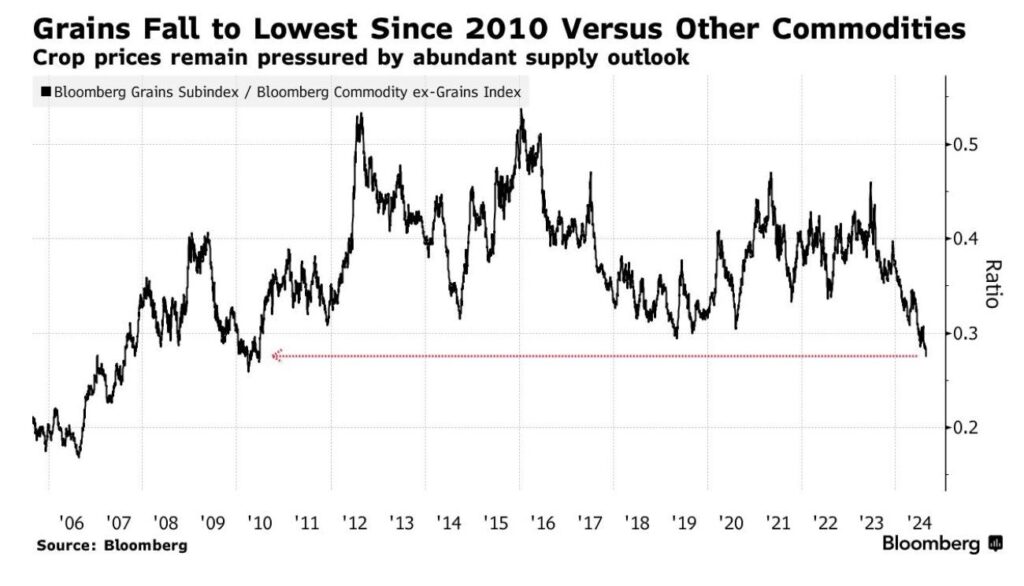

Grain prices have recently fallen to their lowest level compared to other commodities in more than 14 years. This decline is largely driven by favorable weather conditions in major grain-producing regions, leading to a surge in supply. Key crops like corn, wheat, and soybeans are experiencing significant price drops as harvests outpace demand.

The agricultural sector’s strong production output, coupled with a weaker demand from international markets, especially from major importers like China, has further exacerbated the situation. Additionally, rising competition from alternative commodities such as oilseeds and protein crops has put additional pressure on grain prices.

Moreover, the strengthening of the U.S. dollar has made grains more expensive for foreign buyers, reducing export competitiveness and contributing to the price slump. With global grain stocks now at higher levels, traders are increasingly bearish on the sector, expecting continued price weakness unless there is a significant shift in demand or unexpected supply disruptions.

Analysts are closely monitoring the situation, noting that if grain prices remain low, it could lead to financial stress for farmers who may struggle to cover their production costs. This could potentially trigger a reduction in planting for the next season, which might eventually support prices if supply tightens.

Overall, the steep decline in grain prices relative to other commodities reflects a broader trend of oversupply and weakened demand, creating a challenging environment for the agricultural sector.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment