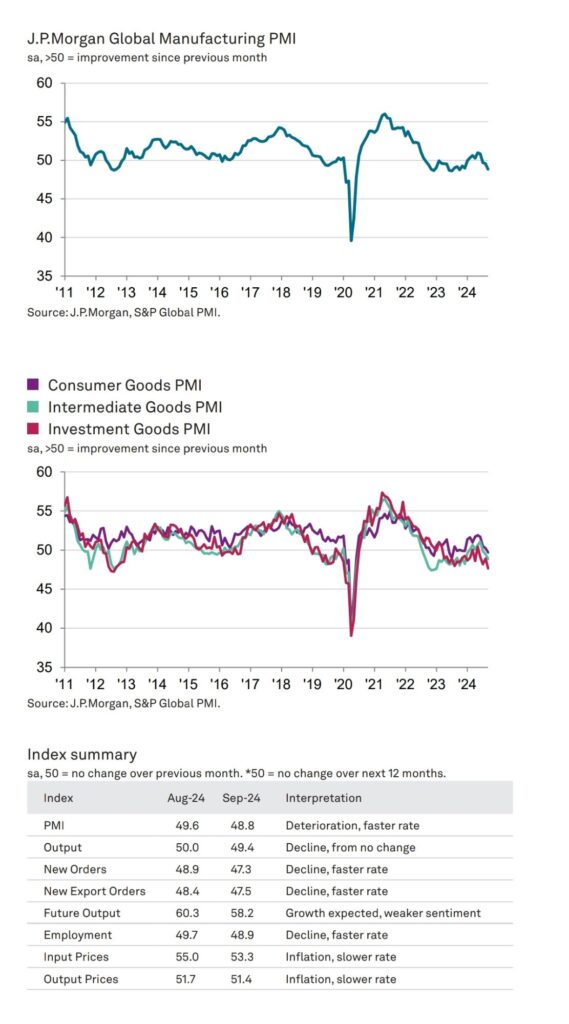

In September, the J.P. Morgan Global Manufacturing PMI fell to 48.8, indicating worsening operating conditions for the third consecutive month. This decline was the fastest seen in nearly a year, with most of the key PMI components showing signs of contraction. Only the suppliers’ delivery times index contributed positively to the overall PMI.

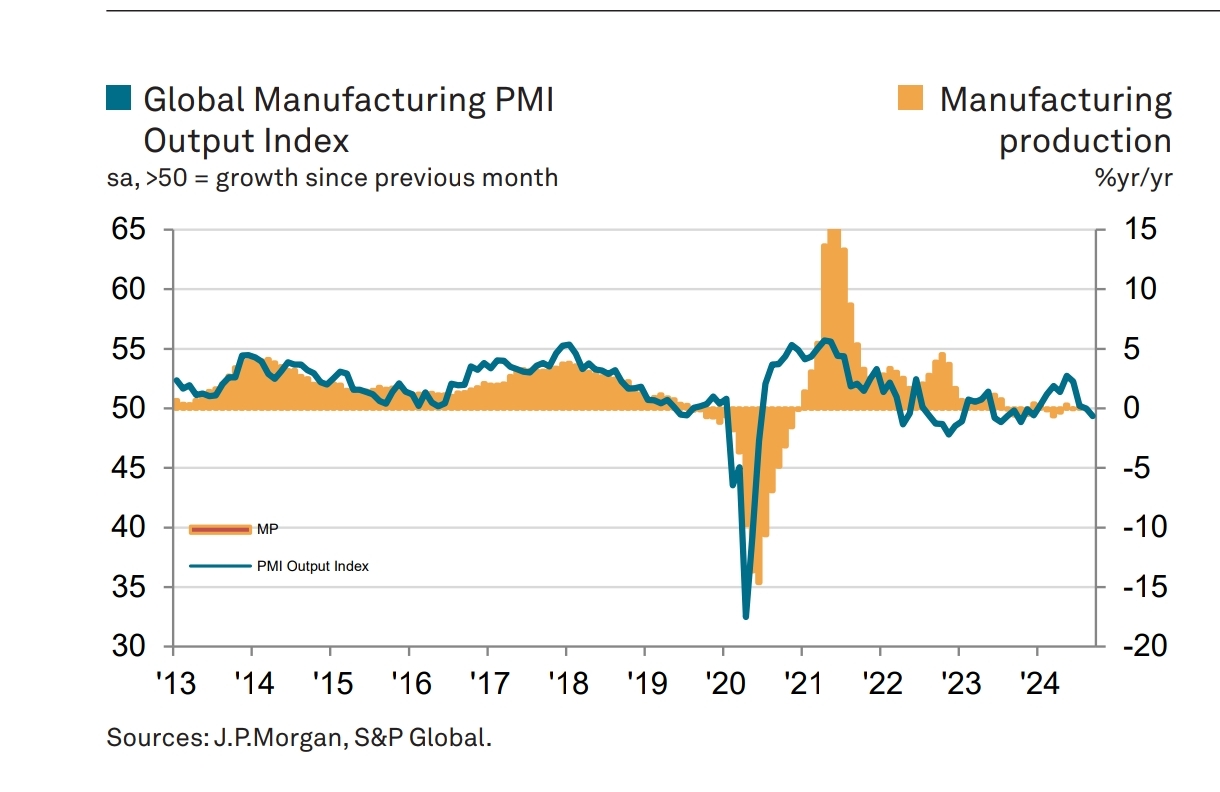

Manufacturing production decreased for the first time this year as companies reduced output due to fewer new orders. New orders fell for the third straight month, and the decline was the steepest since December 2022. International trade also suffered, with new export orders contracting at their fastest rate in 11 months.

Across different sectors, there was a general decline in global industry performance. Both the intermediate and investment goods sectors experienced production contractions in September, while the consumer goods sector continued to grow but at a very slow pace. All three sectors reported drops in total new orders and new export business.

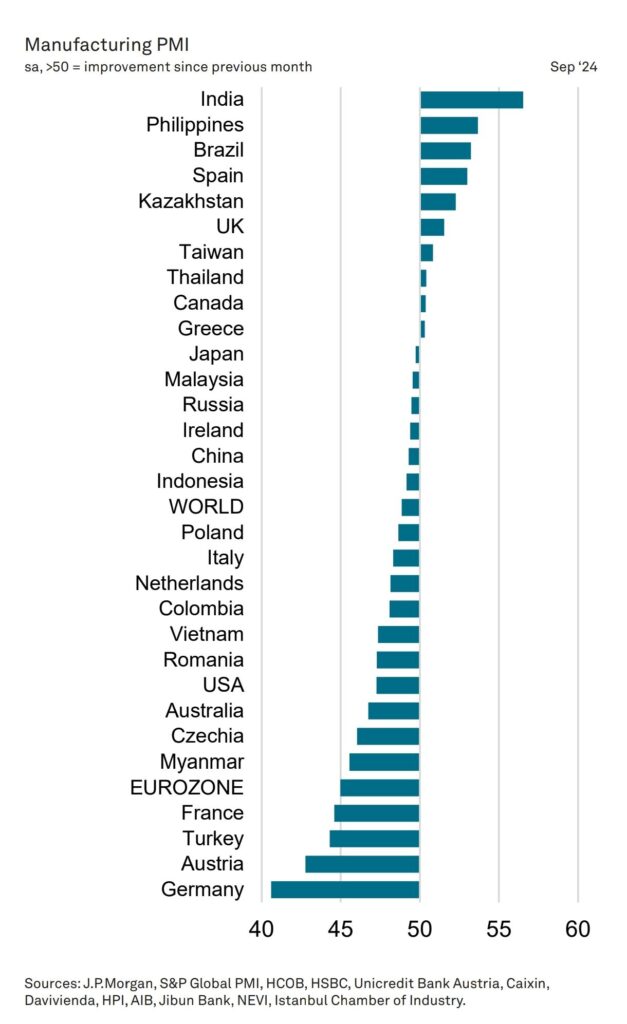

Among major economies, the eurozone faced the biggest decline in production, particularly in Germany. The US also saw a deeper contraction, and Japan recorded a slight decrease. In mainland China, production barely grew for the third month in a row, and other Asian countries experienced a slower rate of growth. Meanwhile, India, Brazil, Spain, and the UK were among the faster-growing countries surveyed.

Survey data from September showed that manufacturers continued to focus on reducing costs and managing under-utilized capacity. Backlogs of work decreased for the twenty-seventh month in a row, leading to further staff cuts. Employment levels fell for the second consecutive month, reaching the lowest point since December 2023. Additionally, purchasing activity was down, and stocks of inputs decreased, while finished goods inventories remained mostly unchanged.

The ongoing downturn and rising caution among manufacturers negatively affected business optimism, which dropped to a 22-month low across all three sectors covered in the survey. The ratio of new orders to inventory also fell to its lowest level since December 2022.

Price inflation pressures eased further in September, with increases in input costs and selling prices being the slowest since March. Suppliers’ delivery times lengthened for the fourth month in a row.

Source: JP Morgan Global Manufacturing PMI Report

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment