Foreign portfolio investors (FPIs) continued to pull out of Indian equity markets, withdrawing nearly Rs 20,000 crore in just five trading sessions (Nov 4-8), mainly due to high stock valuations in India and shifting investments toward China. As a result, FPIs became net sellers in the Indian market, with a total outflow of Rs 13,401 crore in 2024 so far.

This follows a significant outflow of Rs 94,017 crore in October, the largest monthly withdrawal, surpassing the Rs 61,973 crore pulled out in March 2020. In contrast, September 2024 saw FPIs invest Rs 57,724 crore, the highest in nine months. Overall, FPIs have been net buyers in 2024, except in January, April, May, and October.

Foreign investors’ stake in the companies listed in National Stock Exchange (NSE) dropped to 15.98% in October, marking its lowest level in 12 years. This decline was accompanied by an 8.8% drop in the value of their equity assets, which stood at Rs 71.08 lakh crore. In contrast, mutual funds saw their holdings rise to a record 9.58%, amounting to Rs 42.36 lakh crore. Domestic institutional investors (DIIs) also saw a significant increase, with their equity holdings reaching Rs 76.80 lakh crore by September.

The recent surge in the US dollar and rising Treasury yields have also attracted FPIs to invest in the US, expecting a stronger economy. Meanwhile, despite some recent market corrections, Indian stocks remain highly valued compared to other markets, and weak corporate earnings have raised doubts about future growth.

Interestingly, despite these outflows, November has seen an unprecedented 40-50 new FPI registrations, as markets regulator Sebi has relaxed rules for NRIs, allowing them to fully participate and simplifying market entry.

On the debt side, FPIs invested Rs 599 crore in the debt general limit and Rs 2,896 crore in the debt voluntary retention route (VRR) during the period.

India’s offshore rupee bond market reached a new record, with issuers such as the World Bank and the Asian Development Bank (ADB) driving volumes to exceed 420 billion rupees (approximately $5 billion), nearly doubling the figures from the previous year. This surge in demand is fueled by growing confidence in the stability of the Indian rupee, particularly in the context of ongoing volatility in the US dollar. Investors are increasingly attracted to rupee-denominated bonds, as they see the currency as a more stable option amidst global fluctuations in the dollar.

Last week, the combined market value of six of the top-10 most-valued Indian companies dropped by Rs 1,55,721 crore, with Reliance Industries being the biggest loser. The BSE index declined by 0.30%. Among the companies losing value were Reliance Industries, Bharti Airtel, ICICI Bank, ITC, Hindustan Unilever, and LIC, while TCS, HDFC Bank, Infosys, and SBI saw their valuations rise.

Reliance Industries saw a market value loss of Rs 74,563 crore, bringing its valuation to Rs 17.37 lakh crore, while Bharti Airtel’s valuation dropped by Rs 26,275 crore. ICICI Bank’s value fell by Rs 22,255 crore, and ITC lost Rs 15,448 crore. LIC’s market cap dropped by Rs 9,930 crore, and Hindustan Unilever’s valuation decreased by Rs 7,248 crore.

Reliance Industries has lost ₹4.2 lakh crore ($50 billion) in value since July because of poor earnings and a slowing economy. The company’s stock has done worse than the Nifty 50 index, with its oil and chemicals business struggling, and Jio losing subscribers after raising prices.

In contrast, TCS’s market valuation jumped by Rs 57,745 crore to Rs 14.99 lakh crore, Infosys added Rs 28,839 crore, bringing its value to Rs 7.60 lakh crore, and SBI gained Rs 19,813 crore. HDFC Bank’s value grew by Rs 14,678 crore, reaching Rs 13.41 lakh crore.

Despite these fluctuations, Reliance Industries remains the most valuable company in India, followed by TCS, HDFC Bank, and others.

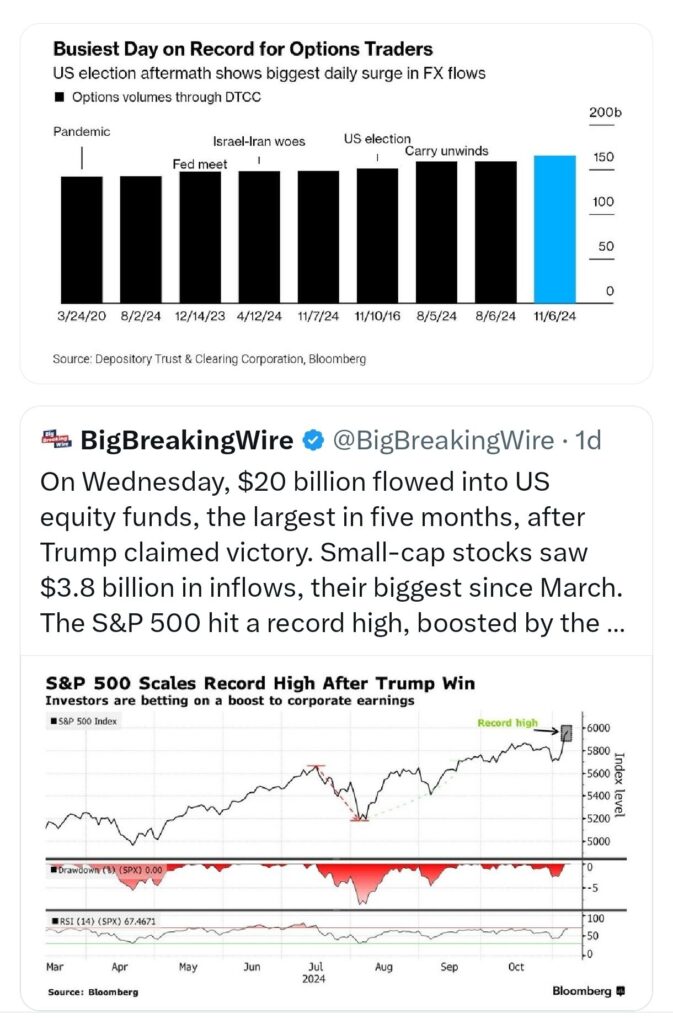

On Wednesday, US equity funds saw a massive inflow of $20 billion, the largest in five months, following Donald Trump’s claim of victory in the election. Small-cap stocks benefited significantly, with $3.8 billion flowing into these stocks, marking their biggest inflow since March. The S&P 500 reached a new record high, driven by the election outcome and a Federal Reserve interest rate cut.

In the wake of Trump’s election win, currency options trading surged to new heights, with $160 billion in contracts being traded in a single day, according to the Depository Trust & Clearing Corporation (DTCC). The US dollar strengthened, leading to a spike in euro and renminbi options. At the same time, the Chicago Mercantile Exchange (CME) saw a staggering $275 billion in foreign exchange (FX) trades. Analysts expect further strength in the dollar, particularly amid ongoing trade tensions.

China’s State Administration of Foreign Exchange (SAFE) reported a net outflow of $98.7 billion in direct equity investments during the first three quarters of the year. At the same time, the country saw new capital inflows for foreign direct investment (FDI) amounting to $60 billion. This indicates that while China continues to attract foreign investment in terms of direct business operations, it experienced significant outflows in terms of equity investments, reflecting a shift in investor sentiment or strategies.

Asian equities were expected to rise following a strong performance in the US stock, bond, and commodity markets after the Federal Reserve’s decision to cut interest rates by 0.25%. The S&P 500 and Nasdaq reached new record highs, and US Treasury bonds saw a boost as Federal Reserve Chairman Jerome Powell emphasized the strength of the US economy. However, India’s market lagged behind other major global markets during this period.

India’s equity cash trading dropped to $12 billion, its lowest level in nearly a year, as the NSE Nifty 50 Index declined by 8% from its September peak, approaching a technical correction. The market sentiment was negatively impacted by disappointing second-quarter earnings reports and continued sell-offs by foreign investors. Investors were left hoping for government stimulus measures to support the market and improve economic conditions.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

2 Comments