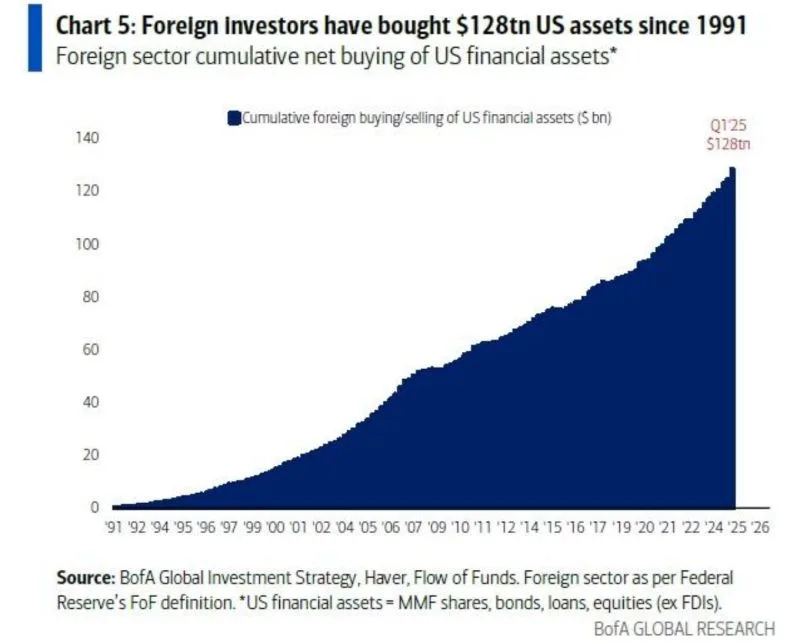

Foreign investors have purchased a massive $128 trillion worth of U.S. financial assets on a net basis since 1991, according to Bank of America. This includes foreign buying of U.S. stocks, bonds, money market funds, credit market instruments, and other assets.

In the past 15 years, this overseas buying has doubled, with much of the growth coming from U.S. equities. The U.S. remains a top destination for global capital, largely because of its stable long-term returns.

According to Federal Reserve data, foreigners now hold a record 18% of the U.S. stock market—around $19 trillion in value.

This level of financial dominance by the U.S. is unprecedented in modern economic history.

Bank of America’s View on U.S. Exceptionalism and De-Dollarization

Bank of America’s Michael Hartnett commented that the topic of U.S. financial dominance is the firm’s biggest internal debate. While clients in Europe and Asia are starting to show interest in de-dollarization for the first time in years, the Middle East remains an exception.

According to Hartnett, any shift away from U.S. financial dominance will be slow and sequential:

First, the U.S. dollar may weaken.

Second, demand for U.S. Treasuries may decline.

Third, U.S. equities might see outflows.

So far, the only visible change is more foreign exchange (FX) hedging against a weakening dollar—not actual outflows. In fact, U.S. stocks and Treasuries are still attracting capital.

He added, “Many investors feel emotionally bearish about the U.S., but in practice, they’re still putting money into American assets.”

What’s Changing in 2025?

Although the U.S. continues to dominate, some trends suggest this dominance may have peaked:

The U.S. received 72% of global equity inflows in 2024. That share is expected to fall to 53% in 2025.

This indicates a slow shift in capital allocation toward other regions like China and Europe.

Bank of America notes that while “America First” policies may aim to reduce the U.S. trade deficit through tariffs and taxes on foreign goods, this strategy is also about reducing the U.S. government deficit.

As the U.S. cuts back on fiscal spending in the second half of the 2020s, other regions—especially China and Europe—may see stronger growth as capital flows shift in their favor.

Bottom Line

The U.S. remains the financial center of the world, but signs of a gradual shift are emerging. For now, foreign investors continue to back U.S. assets—but the coming years may see a more balanced global financial system.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment