Global Banks Reduce U.S. Bond Holdings

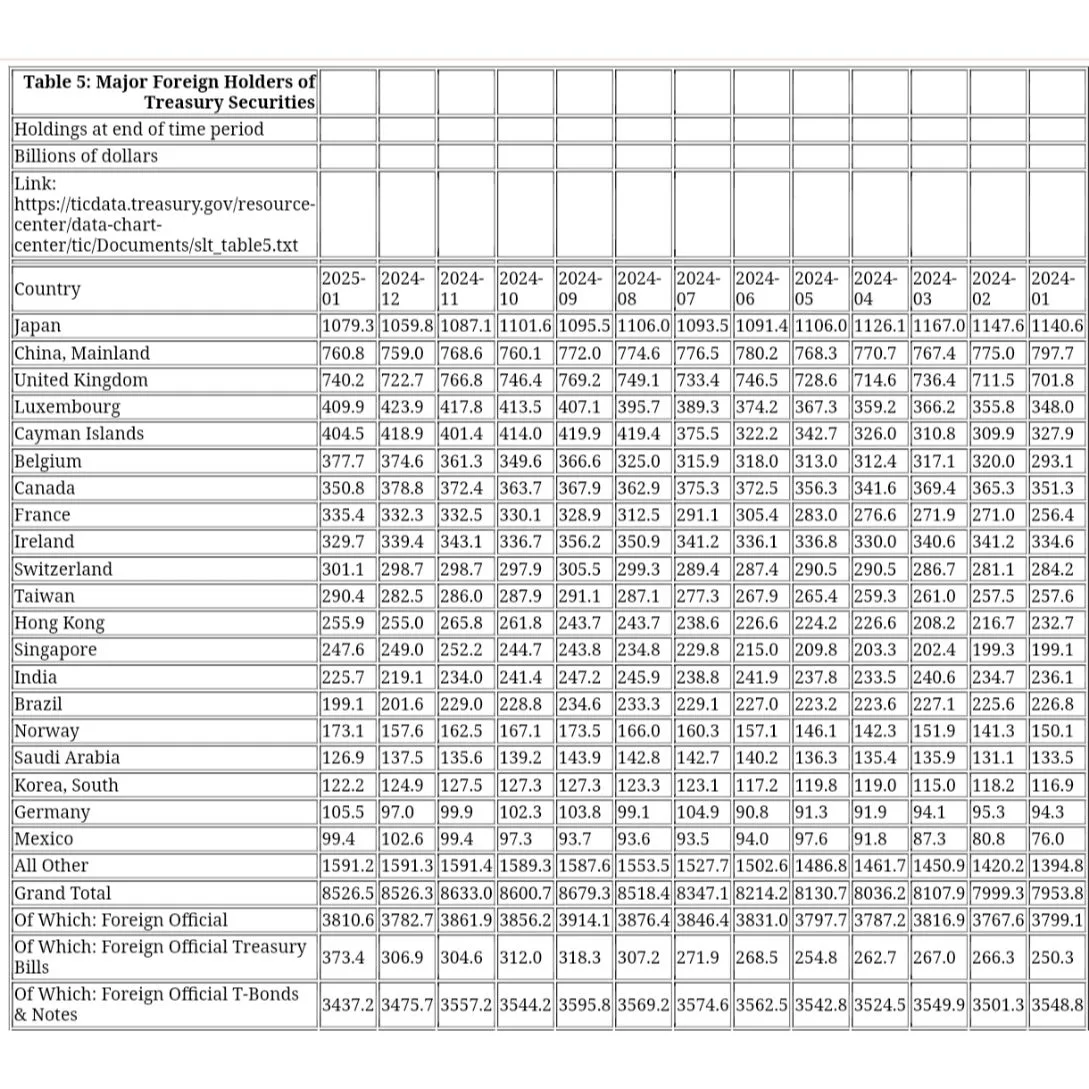

Foreign investors have been selling U.S. Treasury bonds with long-term maturity for three months straight. This trend suggests that central banks worldwide are relying less on U.S. bonds as a financial safety net.

Billions of U.S. Bonds Sold in Recent Months

In January, international investors sold $13.3 billion worth of U.S. Treasury bonds with over a year left to mature. This continued the selling spree, following $49.69 billion in bond sales in December and $34.41 billion in November, a month marked by the U.S. elections.

Canada Leads as the Biggest Seller

Canada sold the most U.S. bonds in January, offloading $28 billion. Its holdings fell to $350 billion from $378 billion in December 2024. Meanwhile, the U.K., which was the top seller in December, became the biggest buyer in January. Norway and Japan also bought more U.S. bonds, ranking as the second and third largest buyers that month.

What This Means for the U.S. Economy

The continuous selling of U.S. Treasury bonds by foreign investors could indicate changing global financial strategies. As central banks shift their investments, it may impact bond yields and the overall stability of the U.S. financial market.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment