The FOMC has decided to keep rates unchanged, maintaining the target range at 5.25% – 5.50%. Additionally, there is no change in the interest on reserves balances, remaining at 5.40%.

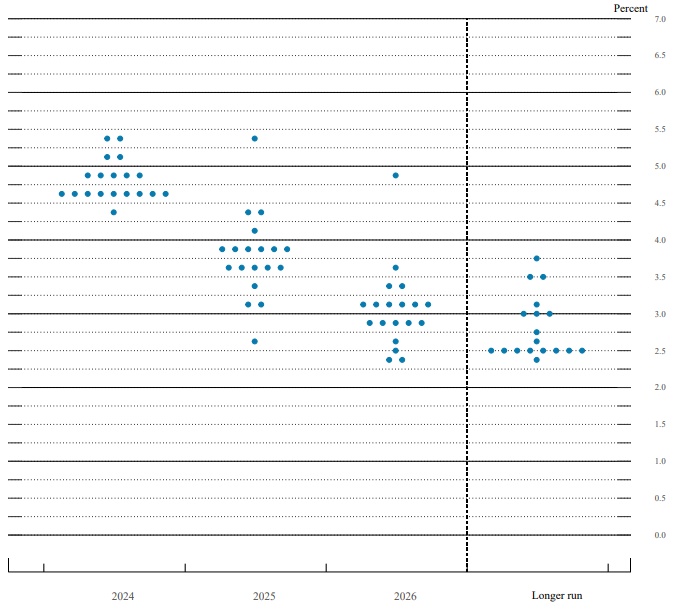

Federal Reserve Projections: Only One Official Foresees Over Three 25 Basis Point Rate Cuts in 2024.

Median View of Federal Funds Rate by Fed Officials at End of 2024 Holds Steady at 4.6% (Previously 4.6%).

Fed Reports: Economic Activity Shows Robust Expansion, Strong Job Gains, and Low Unemployment Rate.

Unanimous Vote by Fed in Favor of Current Policy.

Federal Reserve Projections Maintain Unchanged View of 2024 Policy Rate, Anticipating 75 Basis Points of Reductions.

Fed Stresses Consideration of Wide Array of Economic Data in Assessing Future Policy Stance.

Median View of Federal Funds Rate by Fed Officials at End of 2025 Adjusted to 3.9% (Previously 3.6%).

The Fed Signals No Rate Cuts Until It Gains Greater Confidence in Sustainable Movement of Inflation towards 2% Target.

Fed: Employment and Inflation Goals’ Risks Achieving Better Equilibrium.

Fed Projections Suggest 75 Basis Points Rate Cuts in 2024 from Current Levels, Followed by Additional 75 Basis Points in 2025.

Median View of Fed Funds Rate by Fed Officials in Longer Run Adjusted to 2.6% (Previously 2.5%).

Higher Long-Term Policy Rate Projection Revealed by Fed Projections: 2.6% Compared to December’s 2.5%.

One Less Rate Cut Projected in 2025 Compared to Previous Forecasts.

Fed policymakers anticipate year-end 2024 PCE inflation to remain steady at 2.4%, while core inflation is projected to reach 2.6%, up from 2.4% previously.

GDP growth forecast for 2024 is upgraded to 2.1% from 1.4%, with the unemployment rate expected to be 4.0%, down from the December projection of 4.1%.

Market participants factor in additional Fed easing.

Compared to December, fewer FOMC officials perceive upside risks to their unemployment forecasts, but more anticipate upside risks to their inflation projections, according to Nick Timiraos.

Summary of Fed Decision (3/20/24):

1. The Fed maintains rates at their current levels for the 5th consecutive meeting.

2. The Fed maintains its expectation of three interest rate cuts in 2024.

3. Forecast for core PCE inflation in 2024 is increased to 2.6%.

4. The Fed acknowledges that inflation “has eased but remains elevated.”

5. The Fed indicates it won’t implement rate cuts until it has “greater confidence” in inflation reaching the 2% target.

6. The Fed now anticipates only three rate cuts in 2025 and a reduced number of cuts in 2026.

Summary of Jerome Powell’s statements from the press conference on March 20, 2024:

1. Powell cautioned against reducing rates too quickly, as it could potentially undo progress made in addressing inflation.

2. He suggested that current interest rates are probably at their highest level.

3. Powell acknowledged that unexpected weaknesses in the labor market may require a response from the Federal Reserve.

4. He stated the Fed’s preparedness to maintain higher rates for an extended period if deemed necessary.

5. Powell emphasized the need for increased confidence that inflation is moving towards the target rate of 2%.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment