Fed Cuts Interest Rate by 0.25%

The U.S. Federal Reserve has cut its key interest rate by 0.25%, lowering the range to 3.75%–4.00%. This move was expected by investors as the Fed aims to support the slowing job market while keeping inflation under control.

The decision was divided (10-2 vote), showing differing views among policymakers. The previous rate was 4.25%, and the new rate matches market expectations.

Fed to Stop Balance Sheet Reduction from December 1

In a key policy change, the Federal Reserve announced that it will end its balance sheet drawdown on December 1. Starting that date, the Fed will begin reinvesting all maturing Treasury and mortgage-backed securities into Treasury bills.

Chair Jerome Powell said that while the Fed has reduced its holdings to maintain ample reserves, “it will have to start growing the balance sheet again” to keep enough liquidity in the banking system.

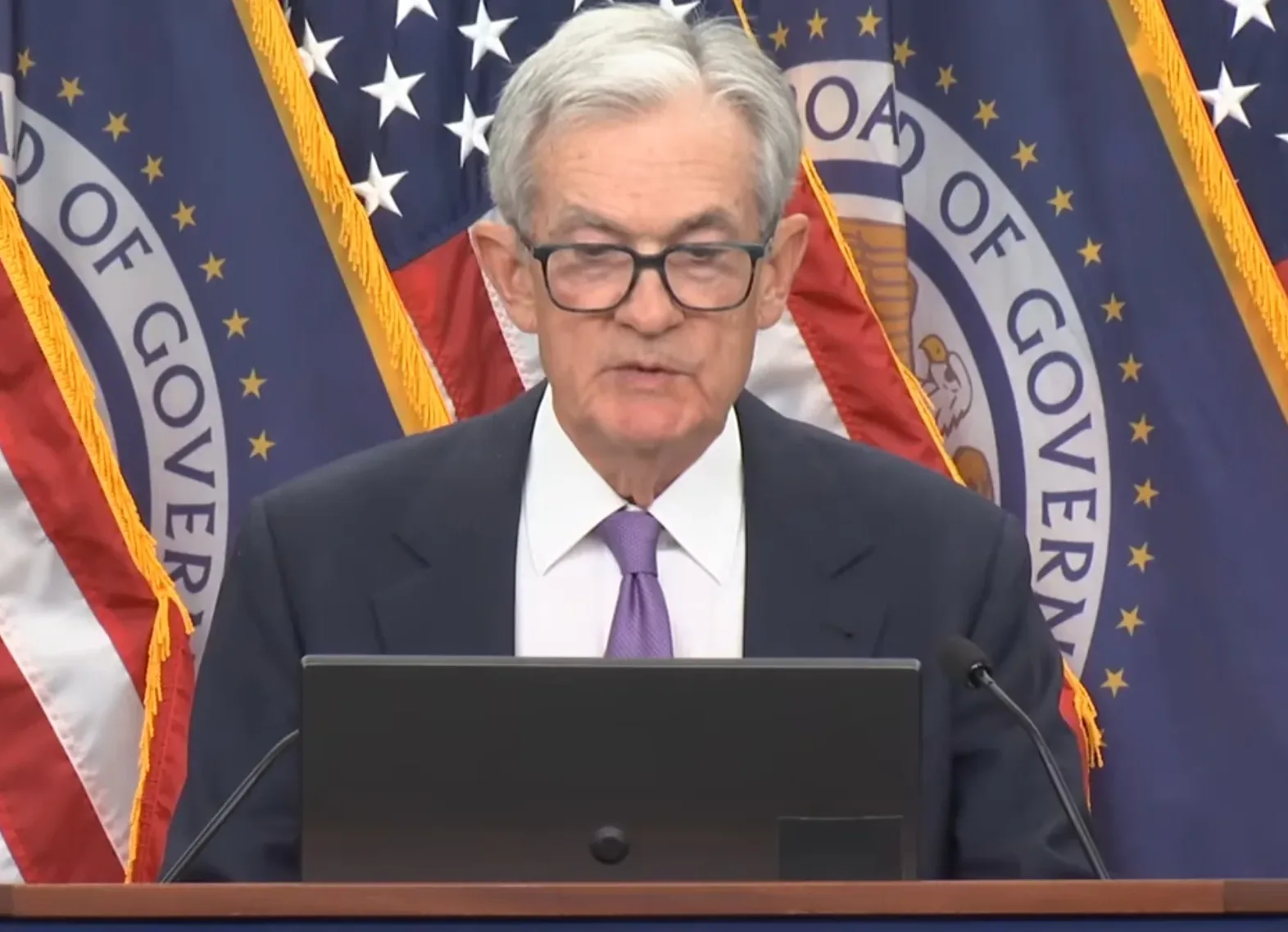

Powell’s Press Conference Highlights

- Employment Outlook: Labor demand has clearly softened, but layoffs and hiring remain stable.

- Inflation: Core PCE and total PCE rose around 2.8%. Inflation remains above target but continues to ease, especially in services.

- Tariffs: Higher tariffs are pushing up some goods prices, but Powell expects the effect to be short-lived.

- December Decision: Powell made it clear that another rate cut in December is “not assured.”

- Risks: Inflation risks are on the upside, while employment risks remain on the downside.

Market Reaction

Following Powell’s comments, US Treasury yields rose. The 10-year yield increased by 6.1 basis points to 4.03%, while the 2-year yield climbed 7.4 basis points to 3.56%.

Traders have now reduced the probability of a December rate cut to 71%, down from 90% earlier in the day, as the Fed signaled a more cautious stance.

Powell on Economic Outlook

Powell noted that the U.S. economy is growing at about 1.6% this year, slower than last year, and that labor market conditions are cooling gradually. He emphasized that the Fed must balance the dual risks of high inflation and slowing employment.

He also mentioned that recent AI-driven layoffs could impact job creation but said overall household finances remain strong. Powell described current policy as “modestly restrictive” and reaffirmed the Fed’s commitment to the 2% inflation target.

Looking Ahead to December

Powell stressed that the Fed has made no decision about the December meeting and that members are split on whether further cuts are necessary. The lack of recent economic data due to the government shutdown may make the Fed more cautious in upcoming decisions.

He concluded by saying, “We must take a balanced approach. There is no risk-free path.”

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment