Corporate Capital Ventures Limited: This Delhi-based merchant banker, which has managed several SME IPOs, is under investigation by the Securities and Exchange Board of India (Sebi) for alleged breaches of merchant banking regulations, as per Money control.

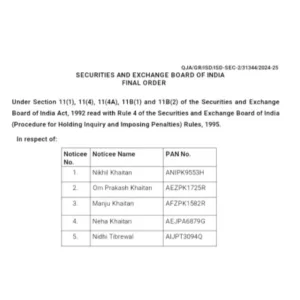

SEBI Notice: Sebi has issued a notice to Corporate Capital Ventures and named two directors, Kulbhushan Parashar and Harpreet Kaur, along with other entities.

Investigation Trigger: The investigation began after Sebi received an anonymous complaint claiming that Kulbhushan Parashar bought shares in companies through his relatives before these companies went public.

Inspection Period: Sebi inspected the company’s operations from August 2022 to June 2024.

SME IPOs Managed: During this period, Corporate Capital Ventures managed six SME IPOs: Oriana Power, Annapurna Swadisht, Droneacharya Aerial Innovations, Crayons Advertising, Creative Graphics Solutions India, and Rocking Deals Circular Economy.

Designated Authority: After the probe, Sebi appointed an officer as the ‘Designated Authority’ on June 19 and issued a notice to the firm and its directors on July 23.

Complaint Details: The anonymous complaint alleged that relatives of Kulbhushan Parashar received 25,000 equity shares and 25,000 bonus shares of Oriana Power through private placement. Jagdish Kumar Prasad, who received these shares, is listed as an immediate relative of Parashar in the IPO prospectus of Rocking Deals.

Unizon Fintech Private Limited: The complaint also claims that this company, where Parashar is a director and shareholder, subscribed to the IPOs of Creative Graphics and Rocking Deals, both managed by Corporate Capital Ventures.

Note: Corporate Capital Ventures denied receiving any Sebi show cause notice, stating, “We have not yet received any notice from Sebi,” as per Money Control.

Kulbhushan Parashar replied on the alleged allegations

Dear Investors,

The allegations against CCV and myself are false and incorrect. Please avoid making defamatory accusations. We are considering legal action against those involved in this smear campaign. My silence should not be taken as an admission of guilt.

Corporate Capital Ventures issues statement clarifying SEBI investigation

Corporate Capital Ventures (CCV) issued a statement regarding media reports on a SEBI probe. They clarified that the post-enquiry show cause notice received on 25th July 2024 is under Regulation 27(1) of the SEBI (Intermediaries) Regulations 2008, related to a routine inspection conducted by SEBI from 27th February 2023 to 2nd March 2023 for the period from April 2021 to January 2023, not from August 2022 to June 2024.

CCV stated that the 2024 notice follows a previous SEBI notice issued on 29th March 2023, to which CCV had provided various documents and clarifications regarding alleged deficiencies. They emphasized that SEBI’s inspections are regular and focused on procedural aspects of merchant banking assignments.

The statement clarified that the 2024 notice is not based on any anonymous complaints from June 2024 or earlier. It also does not address allegations related to IPOs, private placements, or transactions involving specific companies or directors, including Oriana Power and others mentioned.

CCV dismissed recent press articles claiming that the 2024 notice was based on anonymous complaints and contained certain allegations as baseless, false, and defamatory. They assert that such claims are part of a smear campaign by disgruntled individuals against the company and its directors.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment