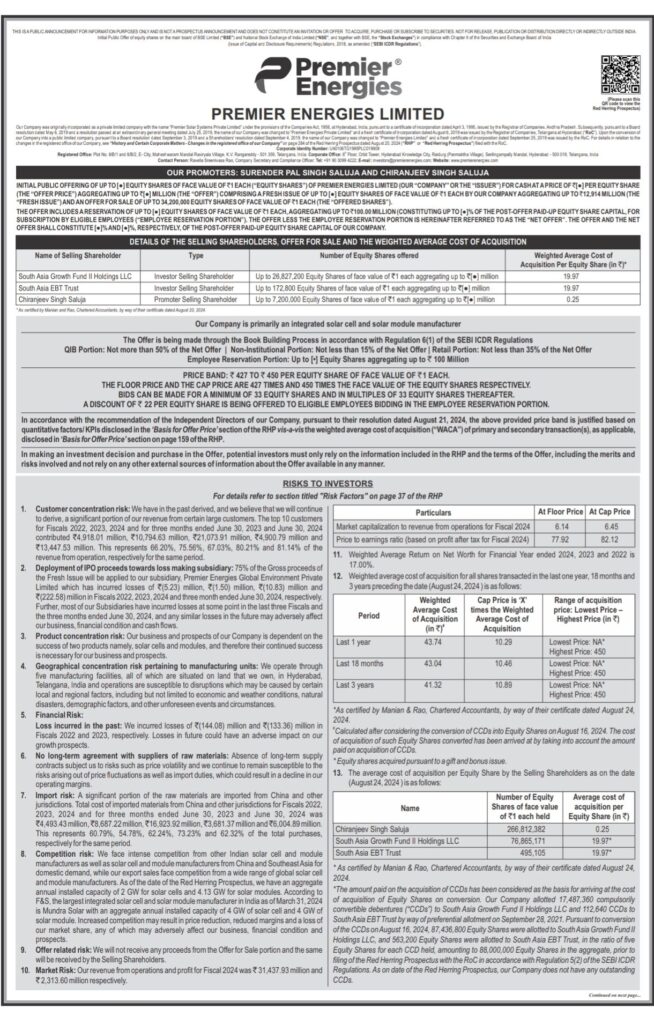

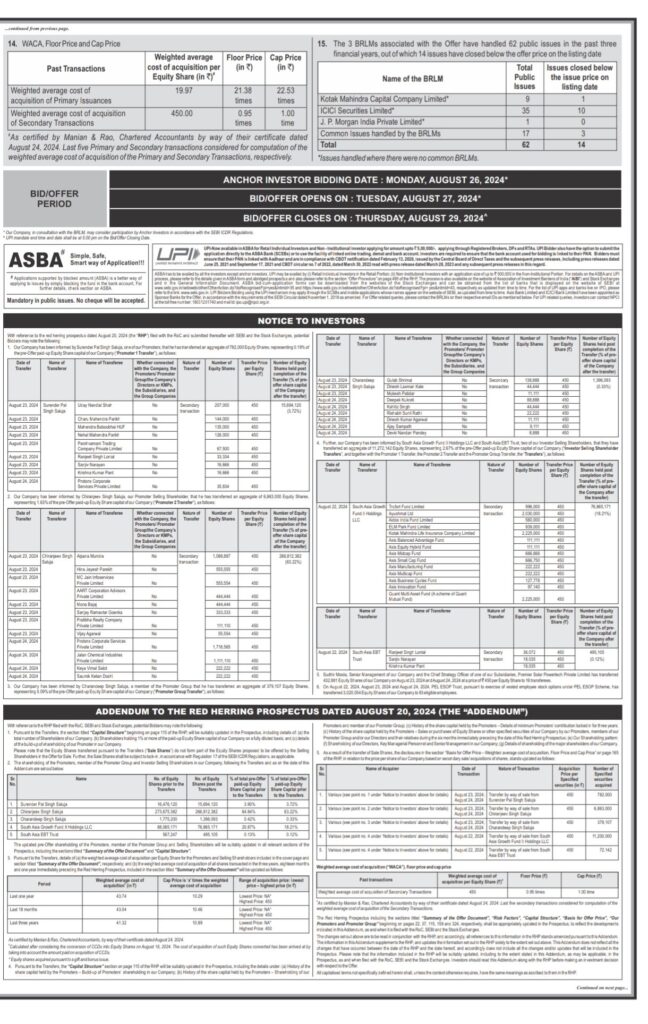

Premier Energies’ promoters and selling shareholders have sold 1,92,96,249 shares, which make up 30.68% of the total IPO size of 6,28,97,778 shares and 23.48% of the total shares, which is 8,21,94,027 shares. These shares were sold at the highest price of ₹450 per share.

The promoters and selling shareholders have offloaded 1,92,96,249 shares, representing 30.68% of the total issue size of 6,28,97,778 shares at the upper price band of ₹450. This sale also accounts for 23.48% of the total shares, which includes both the IPO shares and the shares sold post the RHP filing, amounting to 8,21,94,027 shares. This is a significant divestment, equating to 4.58% of the pre-offer paid-up capital, with a total sale value of ₹868.33 crore against the total issue size of ₹2830 crore at the upper price band.

By selling such a substantial stake at the upper price band of the issue, and to a select group of investors without a transparent process, the promoters have acted in a manner that may be legally permissible but raises ethical concerns, particularly from the perspective of retail investors.

The promoters conducted this large-scale sale on the 23rd and 24th, only informing SEBI on the 26th. However, an error on the SEBI page displaying the addendum meant the public remained uninformed. This raises serious questions: Why were these shares not locked at the time of the RHP submission to the ROC? It appears that the public was kept in the dark during a public issue, leading to significant concerns about transparency and fairness.

This sale represents 4.58% of the company’s pre-offer paid-up capital, amounting to a total of ₹868.33 crore out of the total issue size of ₹2,830 crore.

In addition, South Asia Growth Fund sold 1,12,72,142 shares on 22nd August 2024. However, this sale was not disclosed during the IPO meeting held in Mumbai on the same day, leading to concerns about a lack of transparency.

Despite the heavy focus on IPO pricing, there is surprisingly little concern. For example, the new IPO of Premier Energies is priced between ₹427 and ₹450. The average price for shares placed over the past year was only about ₹43-43.74, showing a massive 1000% increase in valuation within just 12 months. Moreover, the entire offer is for sale, highlighting an IPO craze that far exceeds activity in the secondary market.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment