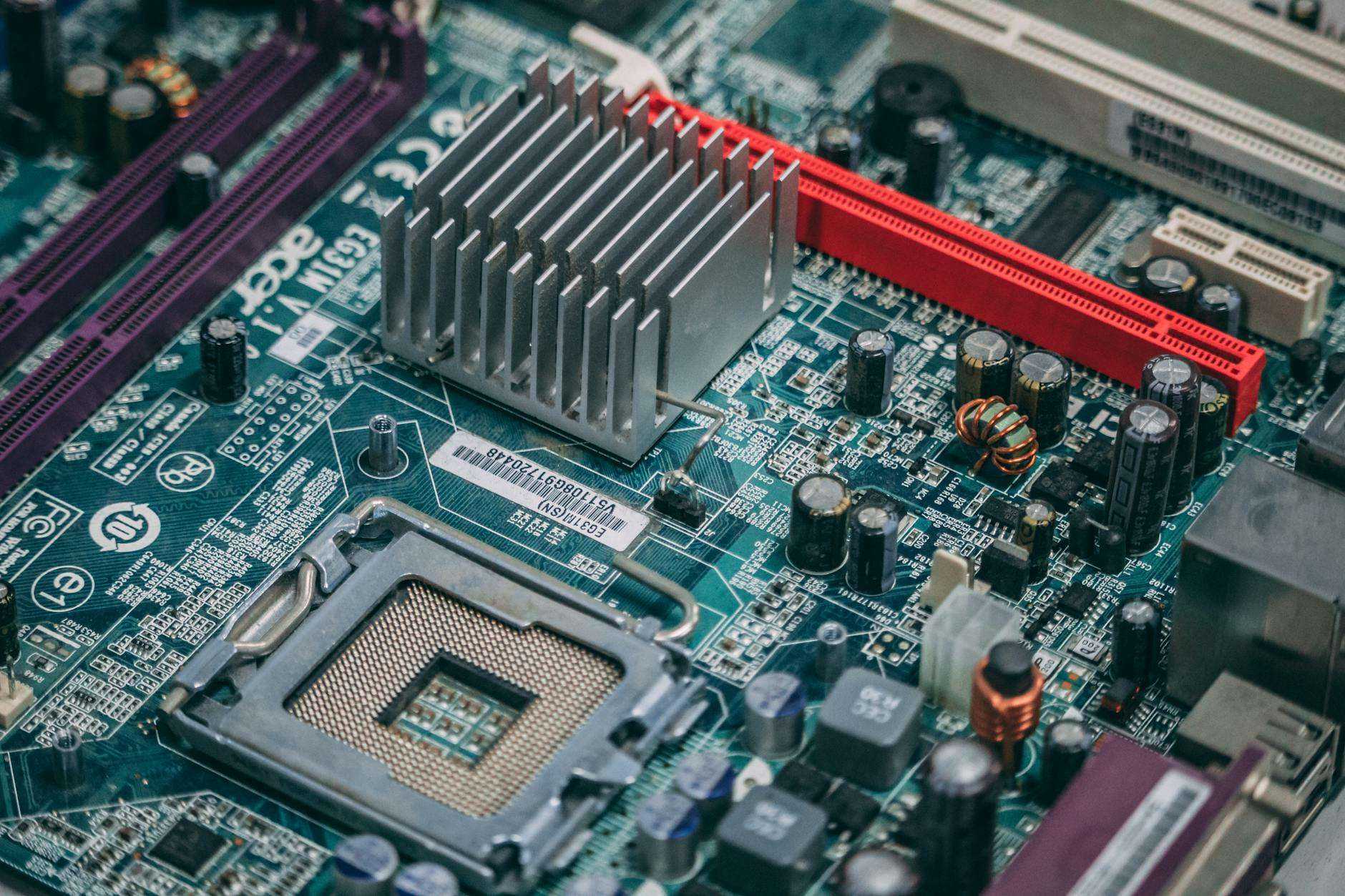

Despite new export curbs, Chinese companies are acquiring U.S. chipmaking equipment to advance their semiconductor industry, as per a recent congressional report.

The bipartisan select committee on China’s annual report, spanning 741 pages, criticizes the Biden administration’s October 2022 export restrictions. These measures aim to prevent Chinese chipmakers from accessing U.S. chipmaking tools for the production of advanced chips at the 14-nanometer node or below.

The report highlights that due to the Commerce Department’s utilization of the 14-nanometer restriction threshold, importers can frequently acquire the equipment by asserting its use in older production lines. With constrained capacity for end-use inspections, verifying that the equipment isn’t employed in the production of more advanced chips becomes challenging.

The United States is working to unravel how Chinese telecom giant Huawei created an advanced 7-nanometer chip for its Mate 60 Pro smartphone in collaboration with China’s primary chipmaker, SMIC. This revelation is set against the backdrop of export restrictions declared last year. Additionally, both Huawei and SMIC were included in trade restriction lists in 2019 and 2020, theoretically preventing U.S. suppliers from delivering specific technologies to these companies.

China observers speculated that SMIC might have used equipment acquired before the October 2022 rules, but the report indicates alternative avenues for obtaining such equipment from abroad. The U.S. successfully closed a significant loophole by persuading ally nations Japan and the Netherlands, both possessing robust chipmaking equipment industries, to implement their own restrictions on exporting crucial technology, hindering China’s access to advanced chipmaking tools.

China strategically accumulated equipment during the lag between the U.S.’s October 2022 rules and Japan and the Netherlands’ similar restrictions in July and September 2023, as detailed in the report. Between January and August 2023, China notably imported $3.2 billion worth of semiconductor manufacturing machines from the Netherlands, marking a 96.1% increase compared to the same period in 2022. While the report doesn’t propose specific solutions, it encourages Congress to request an annual evaluation by the General Accountability Office within six months to assess the efficacy of export controls on chipmaking equipment to China.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment