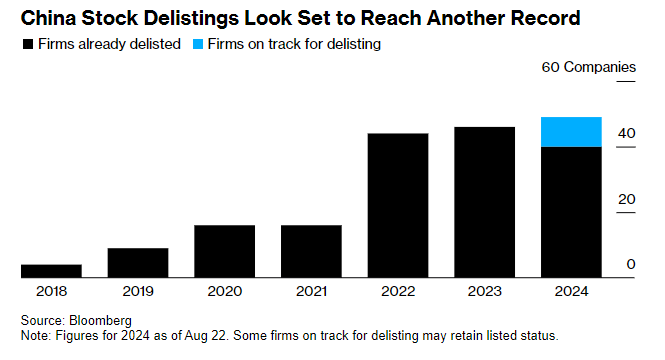

China’s stock markets are on track for a record number of delistings for the third consecutive year, driven by an influx of IPOs over the past decade and stricter regulations aimed at eliminating weaker companies.

So far this year, 40 companies have been delisted from the Shanghai and Shenzhen stock exchanges, with an additional nine firms expected to follow suit, according to data compiled by Bloomberg as of Wednesday. This puts the total number of delistings on pace to surpass the previous record of 45 set in 2023.

Shi Peng, a fund manager at Loyal Capital Ltd., noted that the increase in delistings is a natural consequence of the uneven quality of firms that went public during the registration-based reform period. He explained that while the rise in delistings is to be expected, there are limitations, as mass delistings could harm investor confidence and create broader stability issues.

The number of companies going public on Chinese exchanges has surged over the past decade. In 2021 alone, 503 initial public offerings (IPOs) were completed, a dramatic increase from just 46 IPOs seven years earlier. This boom followed the implementation of new regulations that encouraged more companies to list by adopting a streamlined registration system for IPOs.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment