China’s central bank is expected to reduce the reserve requirement ratio (RRR) for banks by at least 25 basis points in the first quarter of 2025. This move is aimed at boosting economic growth by injecting more liquidity into the banking system.

China’s Economic Growth Forecast Stable

Economists predict that China’s GDP growth will remain steady in the coming years, with a 4.5% growth rate projected for 2025, unchanged from earlier forecasts. For 2026, growth is expected to slow slightly to 4.2%.

Policy Adjustments to Meet Economic Growth Targets

A People’s Bank of China (PBOC) official has stated that China will adjust its economic policies to ensure it meets its annual growth target. This proactive approach signals the government’s readiness to fine-tune its strategies in response to potential challenges or slower growth.

China’s Inflation Forecast for 2025 and 2026

According to a Reuters poll, China’s inflation rate is expected to be 0.8% in 2025, gradually rising to 1.4% in 2026. This suggests a slight increase in inflation over the next two years, potentially due to economic growth or policy adjustments.

PBOC to Ease Pressure on Banks Amid Weak Loan Demand

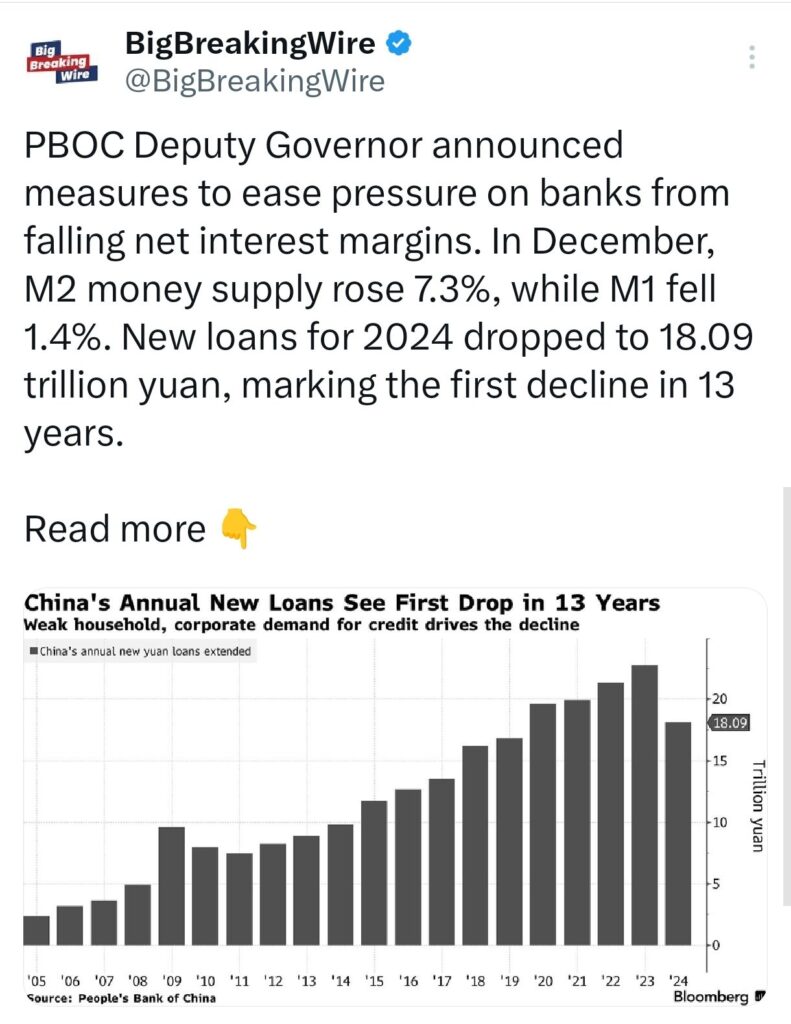

The Deputy Governor of the People’s Bank of China (PBOC) stated that the central bank will take measures to reduce the pressure on banks from falling net interest margins, aiming to stabilize the financial sector.

In December, China’s M2 money supply grew by 7.3% year-on-year, matching expectations. M1 money supply, however, fell by 1.4%, slightly better than the expected 1.8% decline. M0 money supply rose by 13%, a small increase compared to the previous month’s 12.7%. These figures indicate steady trends in the money supply despite broader economic challenges.

Additional financial data showed that total financing in December reached 2.86 trillion yuan, an increase from 2.34 trillion yuan the previous month. New yuan loans amounted to 0.99 trillion yuan, a significant rise from 0.52 trillion yuan in November, suggesting more lending activity despite the overall economic slowdown.

However, the outlook for the year was less optimistic, as financial institutions issued 18.09 trillion yuan in new loans in 2024, a decrease from the 22.75 trillion yuan offered in 2023. This marks the first annual drop in 13 years, reflecting weak demand for loans amid deflationary pressures and a struggling housing market.

China is implementing pay cuts for financial regulatory officials starting this month as part of a broader regulatory overhaul introduced in 2023, according to Reuters.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment