China’s bank lending dropped much more than expected in July due to weak credit demand and seasonal factors, despite the central bank promising to support the economy.

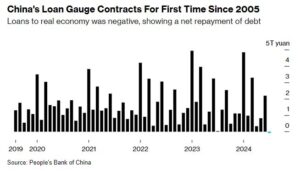

Chinese banks issued 260 billion yuan ($36.26 billion) in new loans in July, which was almost 88% less than the previous month and also below analysts’ predictions. This was a significant decrease from June’s 2.13 trillion yuan and also lower than the 345.9 billion yuan from the same month last year.

For the first seven months of this year, banks issued a total of 13.53 trillion yuan in new loans.

To boost the economy, the People’s Bank of China (PBOC) took action on July 25 by conducting a medium-term lending facility (MLF) operation and lowering interest rates. On the same day, five major state-owned banks reduced their deposit rates to mitigate the impact on their already low profit margins.

The growth of outstanding yuan loans slowed to 8.7% compared to a year earlier, down from 8.8% in June, and below the expected 8.8%.

The annual growth rate of total social financing (TSF), which measures overall credit and liquidity, increased to 8.2% from 8.1% in June. However, total social financing for July fell to 770 billion yuan, less than the forecast of 1.1 trillion yuan and a drop from 3.3 trillion yuan in June.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment