China Publishes White Paper on Trade Relations with the U.S.

On Wednesday, China’s State Council Information Office released an important white paper titled “China’s Position on Some Issues Concerning China-U.S. Economic and Trade Relations.” This document provides a detailed overview of China’s viewpoint on the ongoing economic friction with the United States and clarifies its stance on several key trade-related issues.

Why China Released This White Paper

The white paper was released in response to growing unilateral trade practices and protectionist moves by the United States, which China believes have significantly disrupted the once-stable economic relationship between the two nations. According to Chinese officials, the paper aims to set the record straight and explain China’s consistent efforts toward peaceful dialogue and cooperation.

The Background: U.S. Tariffs on Chinese Goods

Since the U.S.-China trade conflict began in 2018, the United States has imposed tariffs on over $500 billion worth of Chinese exports. These tariffs have been justified using various reasons, including:

National security concerns

Accusations related to fentanyl production

Reciprocal tariff policies

An additional 50% surcharge on existing tariffs

The white paper criticizes these actions as being coercive, isolationist, and damaging to global trade norms. China believes these moves go against the basic principles of the global market economy and multilateral cooperation.

China’s Response: Dialogue and Countermeasures

China, while opposing these aggressive measures, has not remained silent. The white paper emphasizes that China has:

Taken strong countermeasures to protect its national economic interests

Held multiple rounds of trade consultations with U.S. officials

Repeatedly called for dialogue-based solutions

Despite the challenges, China has continued to advocate for peaceful discussions and win-win cooperation to stabilize the trade relationship between the two economic giants.

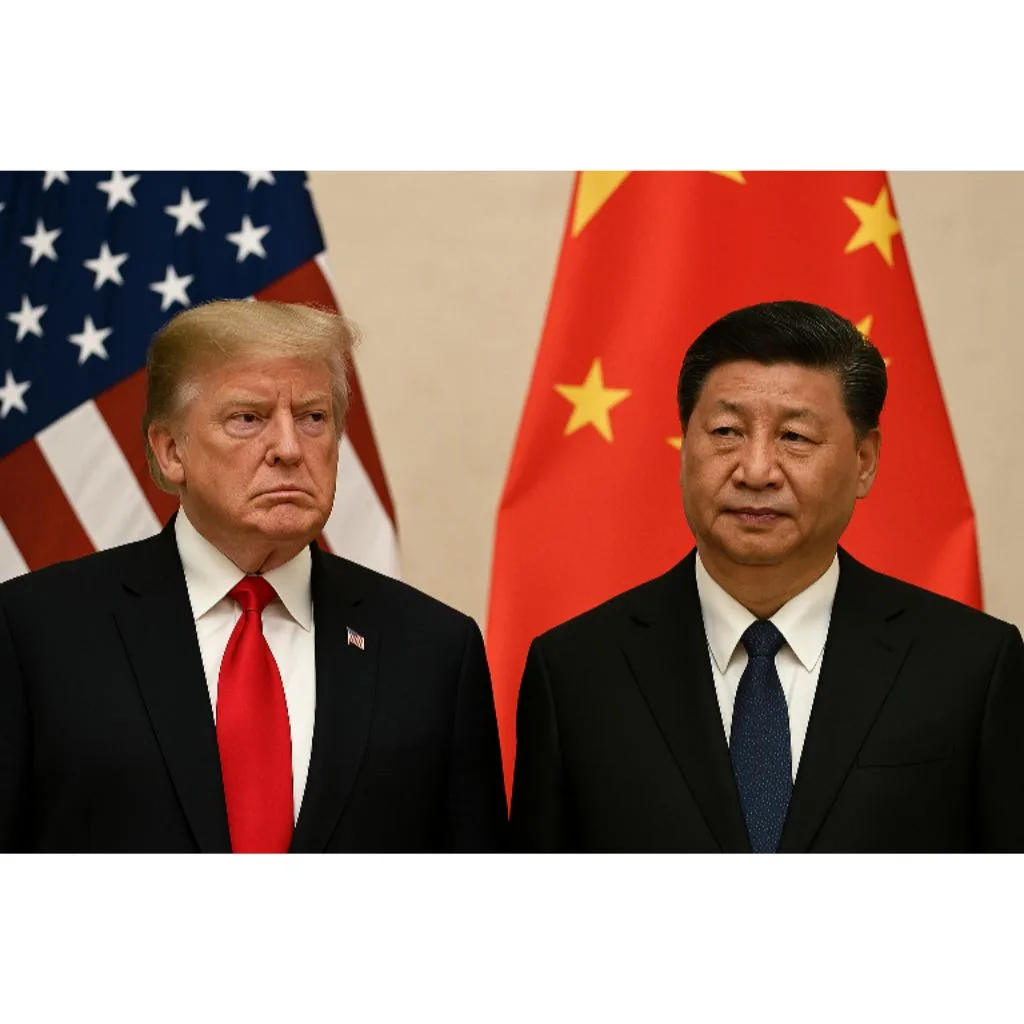

China’s Core Message: Mutual Respect and Win-Win Trade

The Chinese government insists that China-U.S. trade relations are mutually beneficial. As two global powers with different development stages and economic systems, frictions are natural, but they should not escalate into prolonged conflicts.

According to the white paper, the foundation of long-term economic cooperation should be based on:

Mutual respect

Acknowledging each other’s core concerns

Resolving disagreements through constructive dialogue

China Takes Major Steps to Support Its Stock Market Amid Trade Tensions

As the U.S.–China trade war intensifies, Chinese authorities and major brokerages are working together to protect the country’s stock market and economy. Leading firms like Citic Securities, Orient Securities, and Industrial Securities have pledged their support. The Shanghai Stock Exchange recently met with these firms to push for market stability during this uncertain time.

To boost investor confidence, state-backed institutions are also stepping in. Central Huijin and the Social Security Fund have increased investments in ETFs and A-share stocks, aiming to improve liquidity and calm market fears.

Stock Buybacks Pick Up Pace

More than 100 listed Chinese companies have announced stock buyback or share purchase plans. For example:

Sanyi Heavy Industry bought back 5 million shares worth 92.9 million yuan ($12.64 million).

XCMG Construction Machinery plans to repurchase up to 3.6 billion yuan worth of shares.

State-owned Chengtong is using a 100 billion yuan fund to buy stocks of public companies directly.

These buybacks show a united push by both the private and public sectors to stabilize markets and protect them from outside pressure.

Record-Breaking Southbound Investment

Investor interest is also rising. Net buying through Stock Connect’s Southbound link has crossed 29.63 billion yuan, setting a new record high.

Looking Ahead: The Importance of Cooperation

China urges the U.S. to return to the negotiating table in good faith and avoid further escalation. The white paper also warns that continued trade barriers and political confrontation will harm both economies and create instability in global markets.

Conclusion

The newly released white paper by China sends a clear message: while China is ready to defend its interests, it still seeks peaceful and fair cooperation with the United States. As the world watches, the future of China-U.S. economic relations will largely depend on whether both sides can find common ground through dialogue, not division.

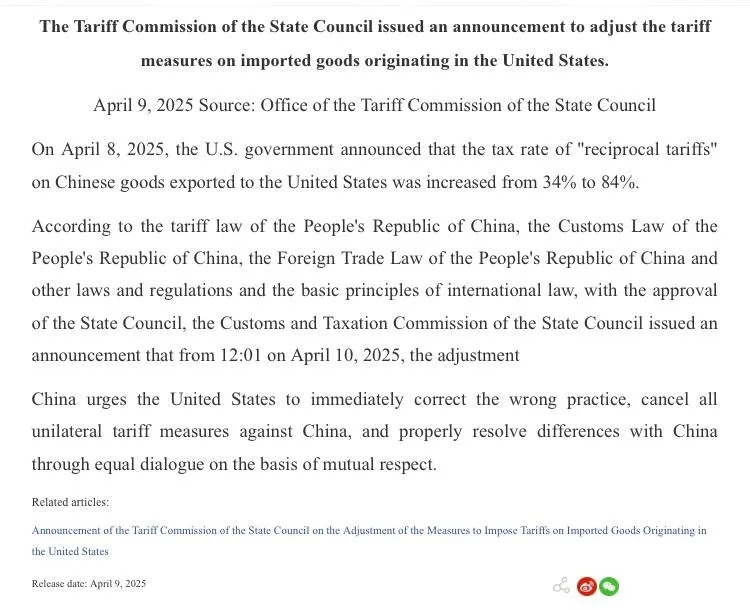

Update

China to Impose 84% Additional Tariffs on U.S. Goods Starting April 10

China has announced it will impose additional tariffs of up to 84% on U.S. goods starting April 10, escalating trade tensions between the two nations. The move follows a government white paper criticizing U.S. protectionist policies and calls for dialogue. China says the tariffs are a necessary response to defend its economic interests and ensure fair global trade practices.

China has filed a new WTO lawsuit against the U.S. over its decision to impose an extra 50% tariff on Chinese exports. At the same time, China’s Commerce Ministry has added 12 U.S. companies to its export control list and labeled 6 others as “unreliable entities,” marking a sharp escalation in the trade dispute.

U.S. Treasury Secretary Bessent said it’s unfortunate that China has imposed 84% retaliatory tariffs. He called China’s move a poor decision that will backfire on them. “They can raise tariffs if they want,” he said, “but it won’t really change anything.”

Bessent says a strong step with China is getting them to acknowledge fentanyl precursors. In a Fox Business interview, he stressed that China must punish those exporting them to the U.S.

U.S. Treasury Secretary Bessent said in a Fox Business interview that Vietnam will join the U.S. for tariff talks on Wednesday. He added that allies meeting with the U.S. should think seriously about how to rebalance the growing influence of China. Bessent also warned that China shouldn’t try to fix the situation by devaluing its currency and urged them to come to the negotiation table.

Bessent, when asked about removing Chinese stocks from U.S. exchanges, said:

“All options are on the table, and the final decision will be Trump’s” – Fox Business Network interview.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment