Introduction

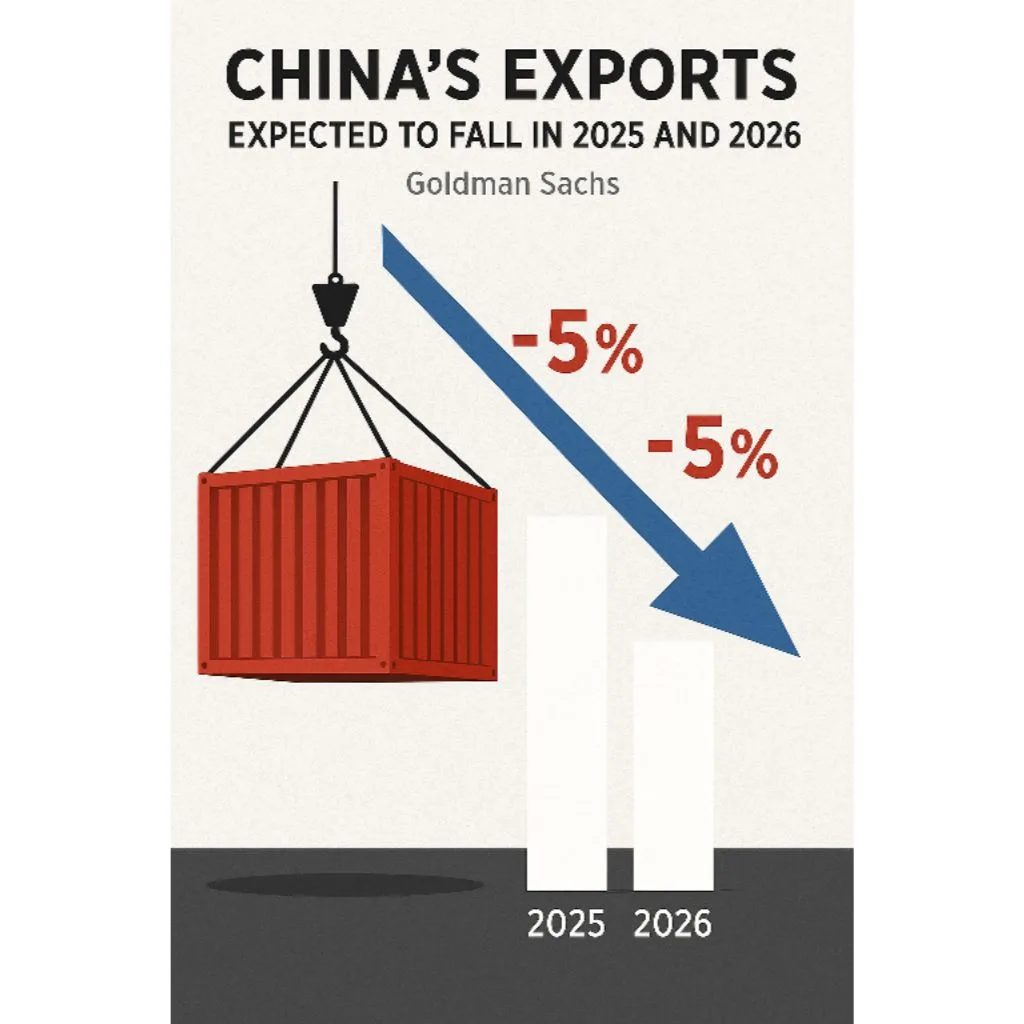

China, one of the world’s largest exporters, is likely to face a decline in export volumes in the coming years. According to a recent research note by Goldman Sachs, China’s total goods exports are expected to drop by 5% in 2025 and another 5% in 2026.

Why Are China’s Exports Falling?

The primary reason behind this expected fall is the rising trade tensions between the United States and China. Goldman Sachs analysts believe that reaching a new trade agreement between the two countries in the near term is “very difficult.” The U.S. is likely to increase tariffs on Chinese goods, which will put more pressure on China’s export sector.

Impact of U.S. Tariffs

The U.S. has already imposed several rounds of tariffs on Chinese imports. A further rise in these tariffs could reduce demand for Chinese products in the American market, which has been a major buyer of Chinese goods for decades. As a result, China’s export growth could slow down significantly.

Support from Trade Re-routing

While direct exports from China to the U.S. are expected to decline, Goldman Sachs also points out that China may still find ways to support its trade. One of these ways is through trade re-routing. This means Chinese goods might be shipped through third countries, especially in Southeast Asia, before reaching their final destination. This indirect route could help China maintain some of its export levels.

Trade Surplus to Shrink Slightly

Despite the expected decline in exports, China will still maintain a trade surplus. However, the size of this surplus is projected to shrink. Goldman Sachs forecasts that China’s goods trade surplus will fall to 3.7% of GDP in 2025, compared to 4.0% in 2024.

China Urges U.S. to Show Sincerity in Trade Talks

China’s Ministry of Commerce has reiterated that the United States, not China, initiated the ongoing tariff and trade war. In a recent statement, the ministry emphasized that if Washington is serious about resolving the issue, it must demonstrate sincerity during negotiations. China highlighted that the U.S. has repeatedly expressed a desire to discuss tariffs and has recently sent signals through various channels indicating a willingness to restart talks.

In response, China has welcomed the outreach and reaffirmed its consistent stance on dialogue, stating, “Talks are always welcome. Our door is open.” This comes amid continued trade tensions between the world’s two largest economies, which have had significant effects on global markets, increasing costs for businesses and consumers on both sides. Informal communication between the two nations has taken place in recent weeks, signaling a potential thaw in trade relations.

Conclusion

In summary, Goldman Sachs expects a challenging period ahead for China’s export sector due to rising U.S. tariffs and ongoing trade tensions. Although trade re-routing may offer some relief, the overall export volumes are still likely to decline over the next two years. This trend could have a wider impact on global trade and economic growth, especially in Asia.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment