MS on Reliance Industries Limited (RIL)

Rating: Overweight (OW), Target Price (TP): Rs 1662

Refining margins are improving after two weak quarters.

Permanent refinery capacity shutdowns are on the rise globally.

The stock has already priced in challenges across key businesses, following a $50 billion market cap drop in Q4FY24. However, it hasn’t accounted for potential improvements.

RIL’s free cash flow (FCF) is expected to grow as approximately 0.6 million barrels per day of refining capacity globally is set to shut in 2025.

Net refining capacity additions will likely be half of demand growth.

The new energy business outlook is positive, with China restricting new solar panel capacity.

JPMorgan on Reliance Industries Limited (RIL)

Rating: Overweight (OW), Target Price (TP): Rs 1468

Refining margins, one of the key reasons for RIL’s underperformance, are recovering.

Retail growth remains weak and unpredictable, but expectations have been significantly lowered.

After the stock correction, RIL’s retail business is valued at around 25x FY26E EBITDA, below historical averages and peers.

Launch of solar panel plants may act as a short-term catalyst.

HSBC sees 15% Sensex upside by 2025, driven by strong small and mid-cap growth amid high valuations and stabilizing economy

HSBC remains overweight on India, with a Sensex year-end 2025 target of 90,520, implying a 15% upside. While economic growth in India is stabilizing at a lower but still healthy level, earnings downgrades are notable given the country’s high valuation multiples. EPS growth is expected to be driven primarily by small and mid-cap stocks, projected to grow at 30%, compared to just 12% growth anticipated for large-cap stocks.

HSBC on Microfinance Institutions (MFIs)

The sector has moved from early signs of asset quality stress in Q1FY25 to a full-blown crisis.

Credit costs are expected to remain high in the second half of FY25.

Annualized AUM growth is likely to moderate to around 15% CAGR.

Performance among players is currently mixed, with clearer differentiation expected in Q3FY25.

Jefferies on Chemicals

SRF has withdrawn its growth guidance due to uncertain demand.

NFIL is expected to resume growth in the second half of FY25, driven by a new agrochemical plant and CDMO contracts.

PI Industries remains the top pick in the sector.

Morgan Stanley on Chemicals

Q2 results showed limited pricing power and margin improvements.

Earnings forecasts were cut again, and companies have reset guidance for 2025 with limited confidence.

While earnings are nearing a bottom, risks still persist.

Preferred stock: Deepak Nitrite.

Jefferies on Logistics

Concor, Gateway, and TCI Express reported volume growth ranging from -3% to +6%.

Delhivery had mixed results: strong B2B volumes but weak B2C performance.

HSBC on Sobha

Rating: Buy, Target Price (TP): Rs 2150

Q2 bookings were below expectations due to weak launches, and margins were impacted by contractual businesses.

The launch pipeline remains strong.

Post rights issue and improved operational cash flows, the company is well-positioned for robust growth.

Bernstein on PFC/REC

Stocks declined sharply due to US SEC concerns over Adani Green and Azure (not under coverage).

Loans provided by REC to Azure are unrelated to the project mentioned in the SEC article.

Operating renewable assets are comparable to bonds and can be sold easily, while under-construction assets can be repurposed for other contracts.

Remain positive on PFC and REC; the recent price dip offers a good buying opportunity.

Jefferies on SBI

Rating: Buy, Target Price (TP): Rs 1030

Management plans to increase deposit growth and balance loan-deposit growth.

Asset quality remains stable, and recoveries will boost earnings in the second half of FY25.

Gradual policy rate cuts may have limited impact due to the bank’s high share of MCLR loans, which protect net interest margins (NIMs).

SBI does not plan to raise capital or list its subsidiaries.

Morgan Stanley on HCL Tech

Rating: Equal-weight, Target Price (TP): Rs 1970

Management commentary indicates a balanced demand environment.

Qualified order pipeline is at an all-time high, and deal wins have not depleted the order book.

Focus remains on profitable growth, with competitive pricing for large deals.

80% of US employees are non-visa-dependent, reducing risk from changes in visa regulations.

The company has expanded nearshore centers, lowering regulatory risks further.

UBS on L&T

Rating: Neutral, Target Price (TP): Rs 4000

Korean Engineering & Construction (E&C) firms have low interest in taking large orders in the Middle East.

Lower risks for Middle East hydrocarbon projects, with a near-term pipeline of $10–12 billion.

Competition is higher in domestic infrastructure than hydrocarbons.

Key growth drivers include domestic infrastructure spending and Middle East project execution.

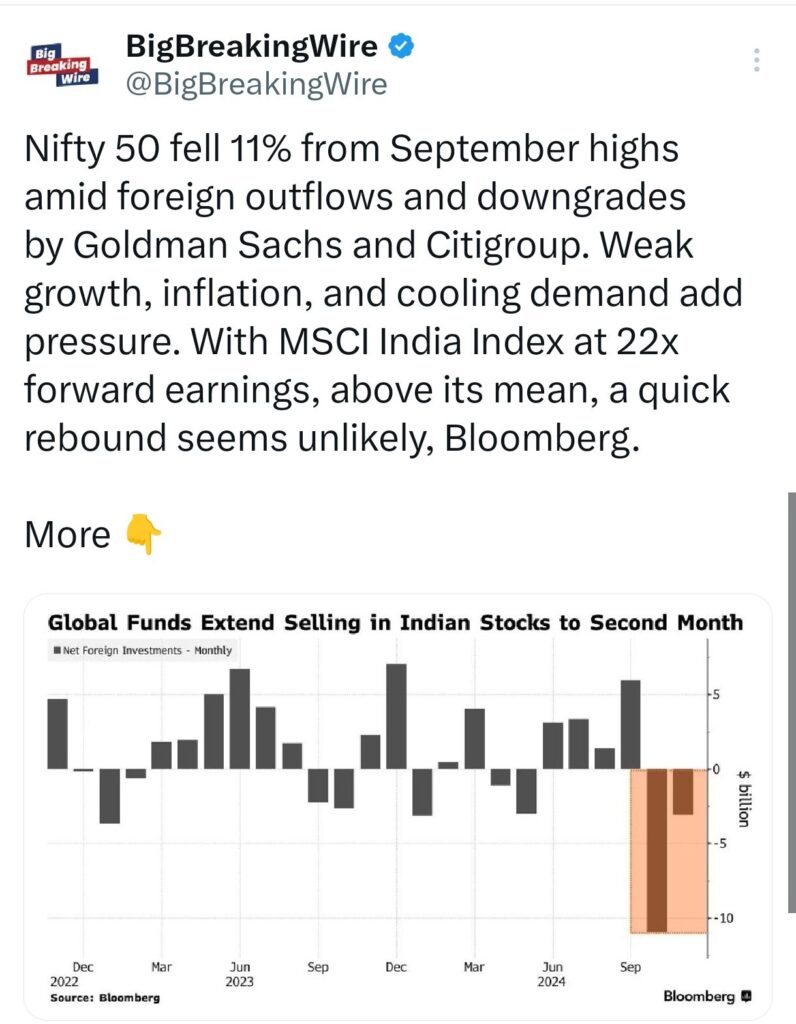

Nifty 50 drops 11% from September highs amid downgrades, foreign outflows, and macroeconomic pressures.

Nifty 50 index has declined by 11% from its peak in September, driven by significant foreign investor outflows and stock downgrades by major institutions such as Goldman Sachs and Citigroup. The market faces additional challenges, including weaker economic growth, rising inflation, and signs of cooling consumer demand. According to Bloomberg, the MSCI India Index is currently trading at 22 times its forward earnings, which is above its historical average. This elevated valuation suggests that a swift market recovery is unlikely in the near term.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment