Macquarie On Swiggy

Macquarie starts coverage with an “Underperform” rating and a target price of Rs 325.

Swiggy has potential, but the path to profitability will be challenging.

Swiggy, India’s second-largest consumer app, has room to catch up to market leader Zomato.

The Quick Commerce segment is complicated and lacks a clear path to profitability.

The brokerage expects Swiggy to reach EBIT break-even by FY28, assuming a 23% growth in core revenue.

Swiggy’s contribution margin is nearly on par with Zomato’s.

To close its profitability gap with Zomato, Swiggy needs around 30% more active users.

Macquarie On Zomato

Macquarie maintains its “Underperform” rating on Zomato but raises the target price to Rs 130 from Rs 100.

Zomato is growing rapidly, but it faces tough competition.

The brokerage reviewed growth strategies and unit economics for both Blinkit and food delivery.

It has cut its earnings forecast and sees risks below market expectations.

The target price was raised due to a lower discount rate.

CLSA On Reliance Industries

CLSA gives RIL an “Outperform” rating, with a target price of Rs 1650.

The stock is close to its conservative value, with a potential 30% upside by 2025.

The recent excitement in India’s solar sector suggests RIL’s upcoming solar PV gigafactory could be a positive factor the market isn’t valuing.

Based on peer valuations, RIL’s solar business is valued at $30 billion, and its new energy division at $43 billion.

This valuation is balanced by a 2-7% cut in expected earnings per share (EPS) for 2025-2027 and reduced valuation for the retail segment.

Jefferies On BSE

Jefferies rates BSE as “Underperform” with a target price of Rs 3500.

BSE’s second-quarter earnings tripled year-over-year to Rs 3.5 billion, with a 31% increase from the previous quarter due to strong growth in operating revenues.

Better cost control was a positive surprise.

There is concern about the impact of SEBI’s new F&O measures, effective November 20.

The brokerage still views the short-term risk-reward outlook as unfavorable.

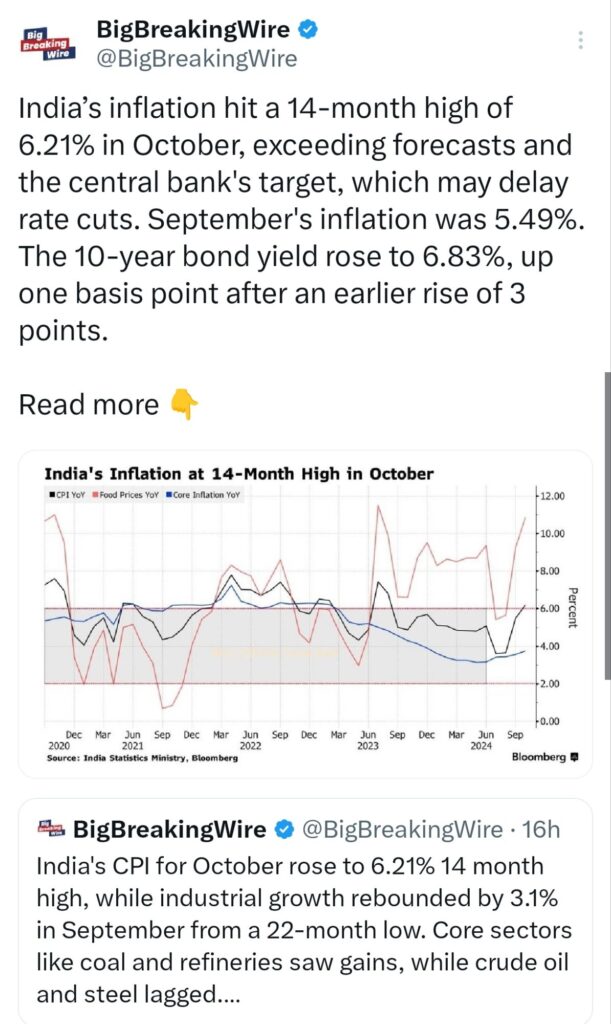

Food prices have led to a rise in inflation, making a December rate cut unlikely.

Core inflation is high but manageable.

The RBI likely won’t cut rates in December but may still support growth if needed.

Industrial production is showing signs of modest recovery.

October CPI inflation rose above 6%, driven by high food prices.

UBS expects food prices to ease from November onwards.

They expect CPI inflation to average slightly higher than the RBI’s target of 4.5% for FY25.

UBS believes a December rate cut will be challenging, though a 75-basis-point rate cut cycle could begin early next year.

India’s inflation surged to 6.21% in October, a 14-month high above forecasts and the central bank’s target, possibly delaying rate cuts. September’s rate was 5.49%, and the 10-year bond yield edged up to 6.83%.

Nomura On Inflation

Nomura believes inflation and growth have both peaked.

They now expect the first rate cut in February 2025, postponed from December 2024.

Nomura predicts a total of 100 basis points in rate cuts during this cycle.

Jpmorgan On Auto Sales

Festive-season sales were strong but may slow down.

Passenger vehicle (PV) sales in October were boosted by discounts, which are higher than last year’s levels.

Post-festive PV sales decline appears sharper than last year’s; 2-wheeler sales decline is in line with seasonal trends.

Auto lenders are cautious on 2-wheeler loans, but captive lenders are stepping in.

Demand from rural and semi-urban areas is stronger than in urban areas.

Demand for new trucks may remain low due to weak freight demand and high vehicle prices.

JPMorgan expects 2-wheelers to outperform PVs and commercial vehicles (CVs).

Their top picks are Mahindra & Mahindra, Bajaj Auto, and TVS.

They anticipate demand pressure on Maruti and Ashok Leyland in the near term.

Macquarie On Britannia

Macquarie downgrades Britannia to “Underperform” from “Neutral” and cuts the target price to Rs 4800 from Rs 5200.

The downgrade is due to growth risks.

Earnings per share (EPS) estimates for FY25-FY27 have been cut by 11% each due to a weak Q2 EBITDA.

The Q2 miss was due to lower gross margins and higher employee costs.

Rising palm oil prices, combined with steady wheat and cocoa prices, pose a risk to H2 margins.

Urban demand concerns aren’t fully factored into the current 56x FY26 EPS valuation.

CITI On Ramco Cement

Citi upgrades Ramco Cement to “Buy” from “Sell” and raises the target price to Rs 1050 from Rs 750.

The company is performing well ahead of Q2, with solid EBITDA per ton due to better cost management.

Ramco’s strategy is supported by its growth plans, and its current valuation provides a cushion.

Jefferies On Samvardhana Motherson

Jefferies rates Samvardhana Motherson as “Buy” with a target price of Rs 215.

Q2 EBITDA rose 34% year-over-year but dropped 12% quarter-over-quarter and missed consensus by 14%.

EBITDA margins fell across divisions but are expected to improve in the second half with cost pass-through to customers.

Morgan Stanley On Samvardhana Motherson

Morgan Stanley rates Samvardhana Motherson as “Overweight” with a target price of Rs 193.

Q2 EBITDA missed estimates by 13%.

Seasonal growth in auto volumes, a stronger balance sheet, and expansion in the non-auto sector support the “Overweight” rating.

CLSA On Samvardhana Motherson

CLSA upgrades Samvardhana Motherson to “Outperform” and raises the target price to Rs 190.

Q2 EBITDA of Rs 24.5 billion, up 30% year-over-year, missed estimates by 11.3%.

Revenue grew strongly across segments, but EBITDA margins dropped in the modules and wiring harness divisions.

CITI On Samvardhana Motherson

Citi rates Samvardhana Motherson as “Sell” with a target price of Rs 125.

Q2 results fell short of estimates.

Management cited challenges in global auto demand, geopolitical risks, and changes in product mix.

They expect a recovery in demand and improved revenue growth and margins in the second half.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment