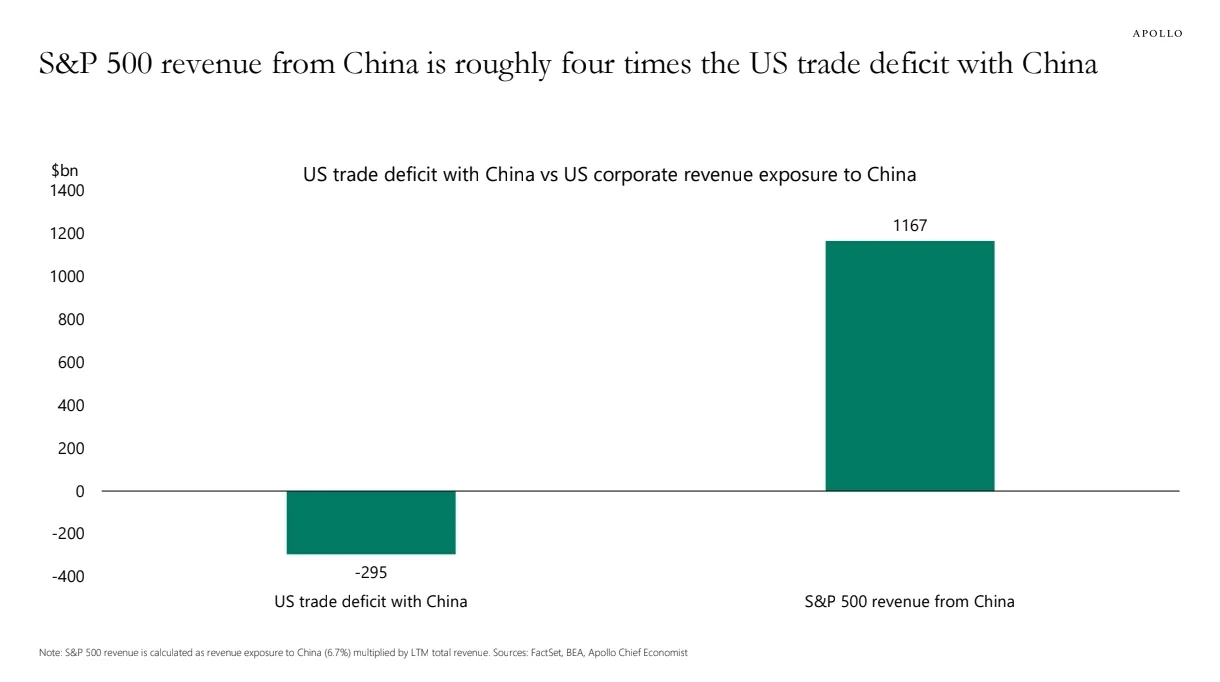

A recent report shows that S&P 500 companies earn about four times more revenue from China than the size of the US trade deficit with China. While most headlines focus on the trade war and the deficit in goods, this data reveals a deeper economic link—American companies are making huge profits by selling directly to Chinese consumers.

Key Numbers at a Glance

US trade deficit with China: -$295 billion

S&P 500 revenue from China: $1.17 trillion

This means that while the US buys more goods from China than it sells (creating a trade deficit), major US companies are still earning far more by doing business in China.

How Big Is China for US Businesses?

According to FactSet’s Geographic Revenue Exposure Database, China accounts for about 7% of total revenue for S&P 500 companies. These are some well-known examples of US brands that operate heavily in China:

McDonald’s: 6,820 restaurants

Walmart: 364 stores

Apple: 43 million iPhones sold in China in 2024

These sales contribute directly to the earnings of US companies and support thousands of jobs in the US.

What This Means for the Future

If the US were to fully decouple from China—cutting all business and trade ties—it would have a major negative impact on US corporate earnings. Companies would lose access to one of the largest and fastest-growing consumer markets in the world.

While reducing reliance on Chinese imports is often discussed in political debates, this data shows that the relationship is two-way. US companies benefit greatly from access to Chinese consumers, and this financial link is much larger than the deficit in goods.

Conclusion

The S&P 500’s $1.2 trillion in revenue from China shows that US corporate exposure to China is not a weakness—it’s a strength. Any policies aimed at reducing ties with China must consider the cost to American businesses and investors.

Source: Apollo Chief Economist, FactSet, BEA

Be First to Comment