There are fresh signs that the risk of a U.S. recession is rising sharply.

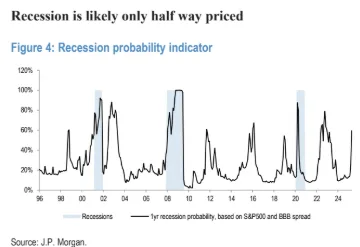

According to market data, the odds of a recession in the next 12 months — based on the S&P 500 earnings yield and the spread on BBB-rated corporate bonds — have jumped to 60%. This is the highest reading since 2022.

Over just the past few weeks, the probability of a downturn has tripled. Historically, whenever this measure crossed 80%, the U.S. economy ended up falling into a recession.

One big warning sign is coming from the credit market. The spread on BBB-rated corporate bonds has surged by 40 basis points over the last six weeks, reaching 1.42%. This is close to the highest levels seen since November 2023.For comparison, the peak during the 2023 U.S. banking crisis was 1.98%.

JPMorgan noted that while recession risks have risen sharply, they are still lower than the panic levels seen in 2022 — and back then, the U.S. still managed to avoid an actual recession. However, JPMorgan also warned that risks could rise further from here.

In short, the bond and stock markets are both flashing major warning signals. Even if a full-blown recession doesn’t happen immediately, history suggests that a sharp slowdown in U.S. economic growth could be ahead.

One Comment