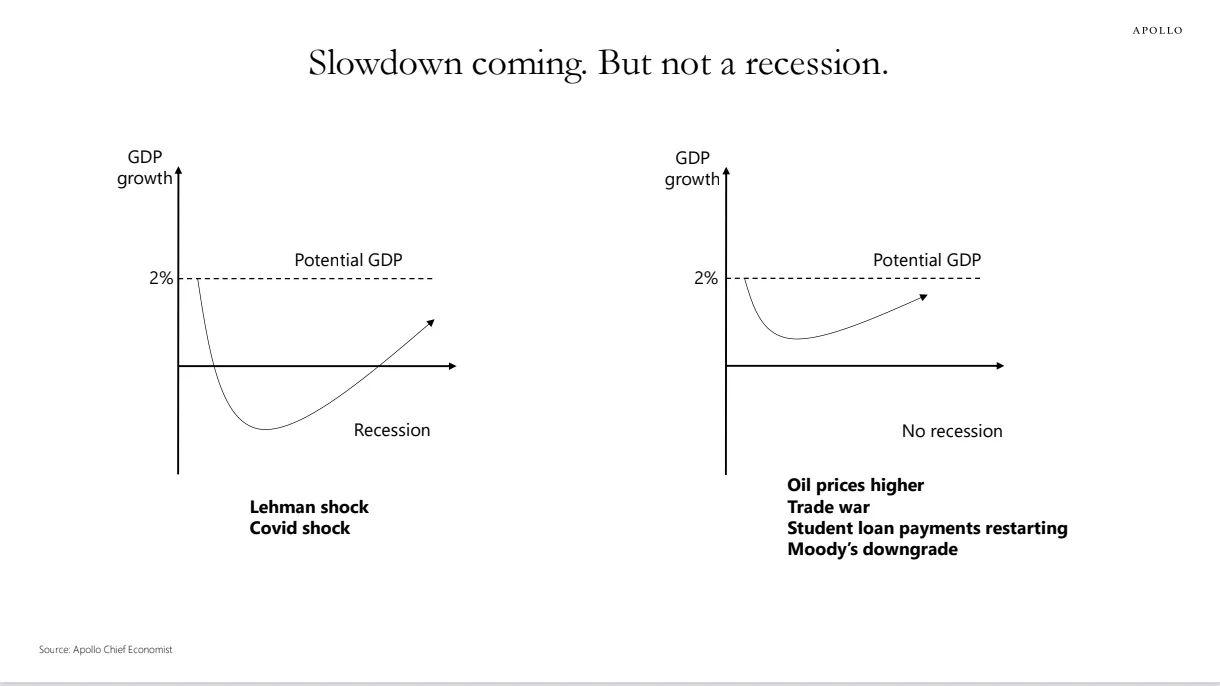

Recent developments suggest that the US economy is slowing down, but a recession is unlikely.

The main reasons for this slowdown include:

Higher oil prices

Rising tariffs from ongoing trade tensions

Restart of student loan repayments

Higher long-term interest rates due to fiscal pressure

These factors are putting pressure on economic growth. However, when we measure their combined impact, they don’t appear strong enough to cause a full-blown recession.

Unlike past major shocks such as the 2008 Lehman crisis or the COVID-19 pandemic, today’s issues are less severe. The chart below shows the difference — in previous recessions, GDP growth fell deeply below zero. Today, we expect growth to slow but stay positive.

Still, these risks could grow. If oil prices rise further, tariffs expand, or interest rates jump again, the economy could face a sharper decline.We’ll continue monitoring these indicators closely in the months ahead.

A $10 increase in oil prices could reduce US GDP by 0.4% and push inflation up by 0.35%, according to the Fed’s model. Alongside tariffs and tighter immigration rules, this adds to stagflation risks—creating a tough challenge for the Fed before its next policy decision.

Key Takeaway:

The US economy is likely to experience a slowdown — not a recession — unless external risks worsen significantly.

Source: Apollo Chief Economist

Be First to Comment