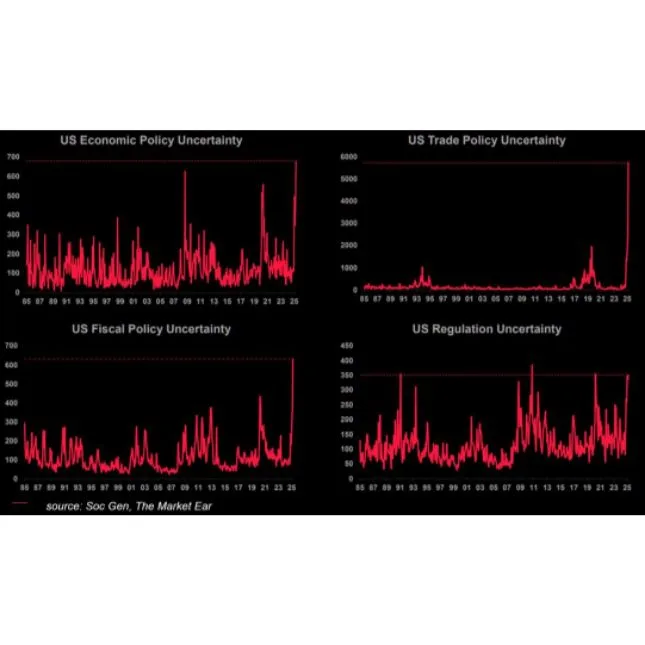

A new report from Societe Generale and The Market Ear shows that uncertainty around U.S. government policies has surged in 2025 to record-breaking levels. The data is based on four key areas: economic policy, trade policy, fiscal policy, and regulation.

1. Economic Policy Uncertainty

This shows how unclear or unpredictable the U.S. government’s overall economic direction is. In 2025, this index has jumped to its highest level since 1985. Past spikes were seen during the 2008 financial crisis and the 2020 pandemic, but 2025 has now surpassed them.

2. Trade Policy Uncertainty

Trade policy uncertainty has exploded—reaching a historic high of nearly 6000 points. This may be due to ongoing tensions in global trade, especially between the U.S. and China, and recent political changes that could alter key trade agreements.

3. Fiscal Policy Uncertainty

Uncertainty in government spending and tax policy has also hit record highs. This reflects growing concerns over budget deficits, rising debt levels, and unclear fiscal strategies ahead of the U.S. elections.

4. Regulation Uncertainty

Regulatory policy, which includes rules affecting businesses and industries, is also at its highest level in recent years. This could be tied to expectations of stricter regulations or sudden policy shifts under new leadership.

Conclusion: All four areas show a strong rise in uncertainty in 2025. This kind of environment can cause nervousness in the markets, reduce investments, and affect business decisions. Investors, businesses, and policymakers need to stay alert as the political and economic landscape continues to shift rapidly.

Be First to Comment