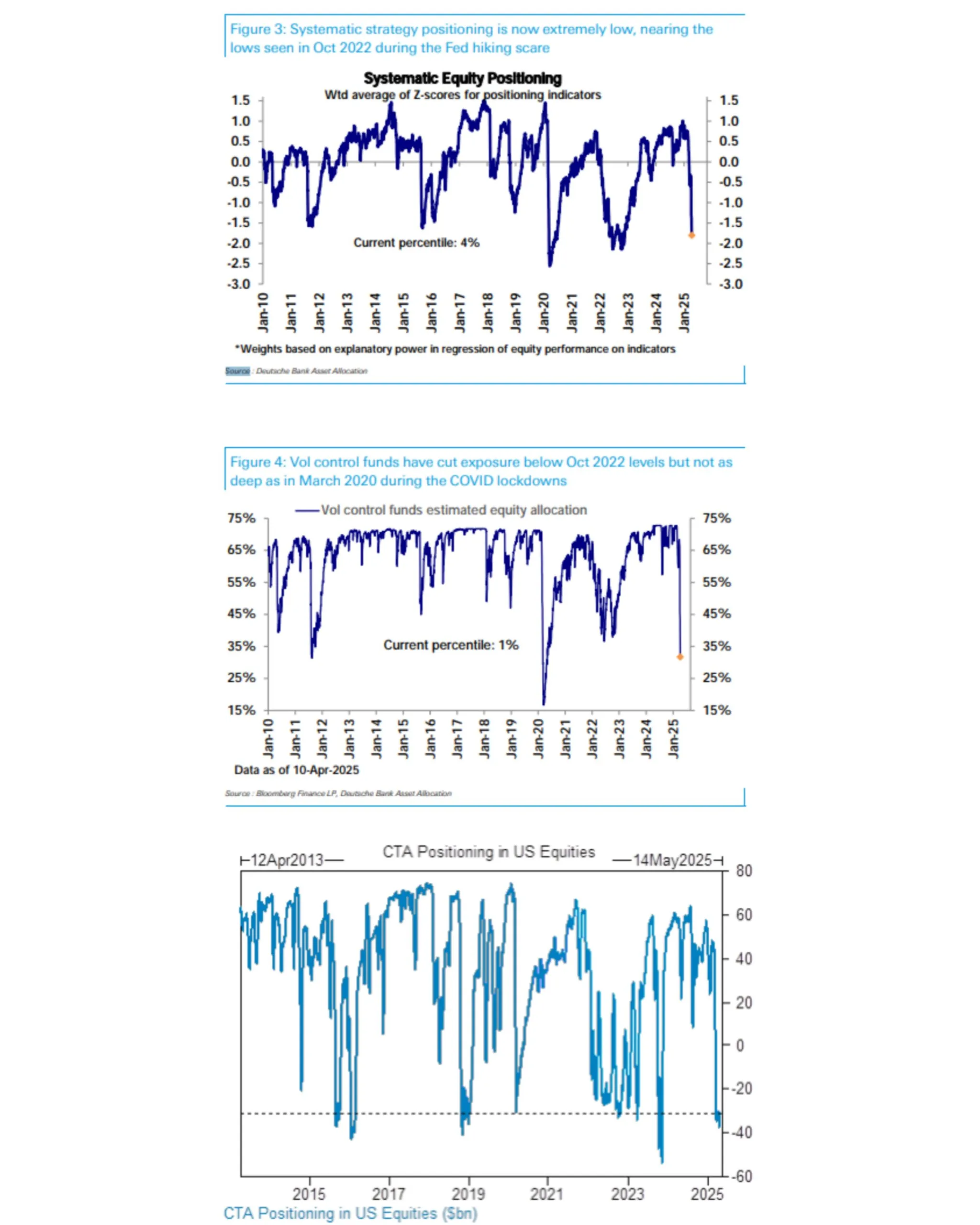

Systematic investors, including CTAs and volatility control funds, are now holding extremely low equity positions—some of the lowest in years. Deutsche Bank notes that overall positioning by systematic strategies has dropped to nearly two standard deviations below the long-term average. This level is close to the panic seen in October 2022 during the Fed’s aggressive rate hikes, although still not as extreme as the historic lows of March 2020 during the COVID crash.

Current CTA exposure to U.S. equities is hovering around record lows, according to both Deutsche Bank and Goldman Sachs. Meanwhile, volatility control funds have also reduced their equity exposure to levels not seen since 2022. Interestingly, these funds are now in a spot where even minor market dips—less than 3%—could trigger fresh equity buying, as such moves aren’t enough to maintain current volatility levels.

If market volatility begins to settle, analysts believe that systematic strategies may gradually start increasing their exposure again. The setup could pave the way for a wave of equity buying if calm returns to the markets.

Be First to Comment