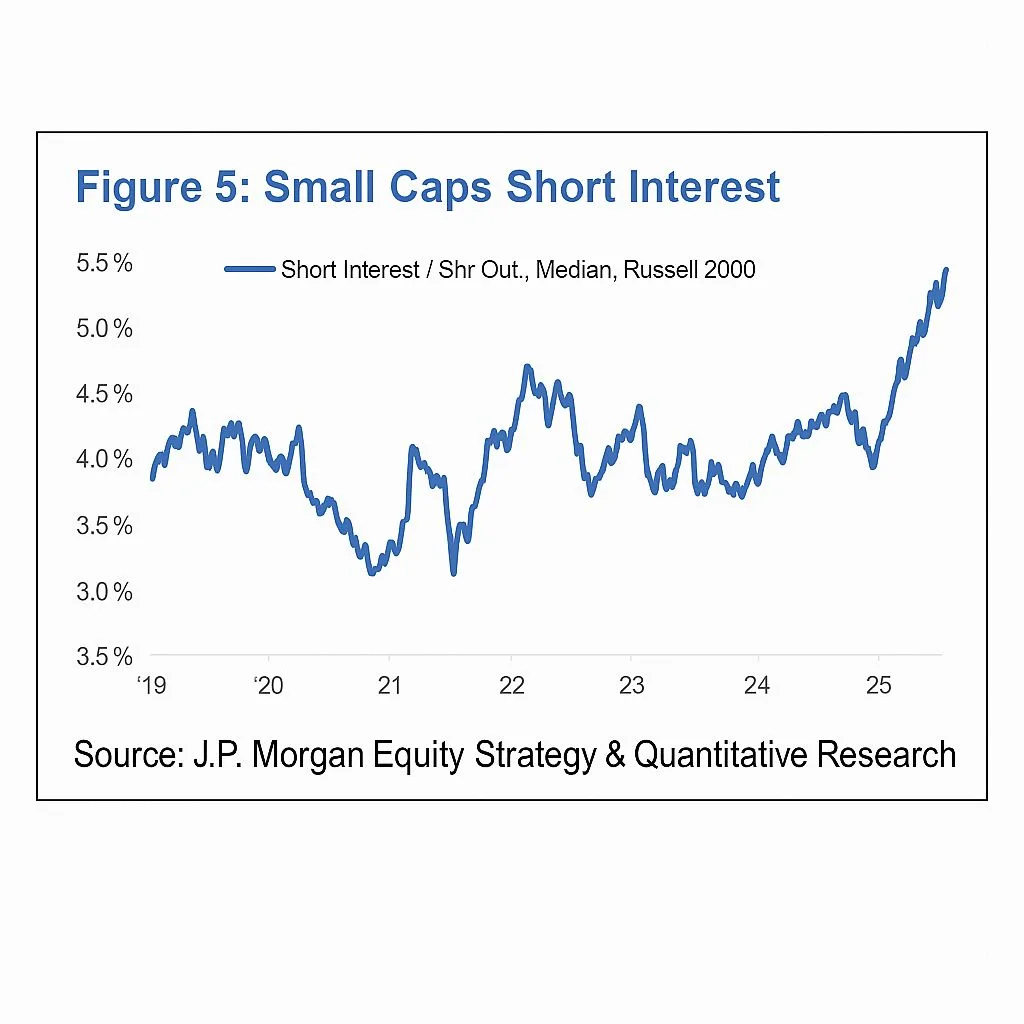

According to data from J.P. Morgan Equity Strategy & Quantitative Research, short interest in small-cap stocks—measured as the median short interest relative to shares outstanding in the Russell 2000 index—has surged to the highest level in over five years. The chart highlights a sharp uptick since late 2024, with current levels exceeding 5.5% as of early 2025.

This surge indicates growing bearish sentiment or increased hedging activity among investors toward small-cap stocks. Historically, such spikes in short interest have often coincided with increased market volatility, broader economic uncertainty, or sector-specific stress.

The trend may signal caution among institutional investors about the near-term outlook for small-cap companies, possibly due to tightening credit conditions, weaker earnings visibility, or broader macroeconomic concerns.

[…] Small Caps Short Interest Hits 5-Year High: J.P. Morgan Report Deutsche Bank Flags Sharp Drop in Foreign Investment in U.S. Assets Foreign Investors Pour Billions into Indian Stocks Amid Trade Optimism […]