Retail investors have made a strong comeback in the stock market. According to JPMorgan’s Emma Wu, they bought a net $3.2 billion worth of stocks in the five days ending Wednesday — a sharp turnaround from the quiet trading activity seen the previous week.

Instead of focusing on individual stocks, most retail investors preferred exchange-traded funds (ETFs). They mainly invested in broad market ETFs, as well as funds linked to gold and energy sectors.

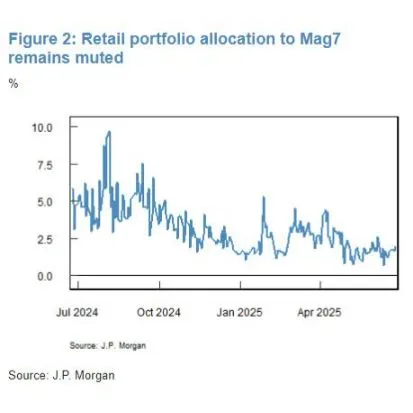

Surprisingly, interest in the popular “Magnificent 7” tech stocks — including companies like Apple, Microsoft, and Nvidia — remains low. These stocks now make up just 2% of retail investors’ overall portfolios, showing a clear trend of diversification.

Retail investor activity is surging to record highs, with nearly half of total market volume driven by penny stocks. Pre-market trades in sub-$1 stocks now account for 20%, surpassing the frenzy seen in 2020. Options trading is also booming.

Foreign investors have purchased $128T in U.S. assets since 1991 and now hold a record $19T in U.S. stocks—18% of the market. But their share of global equity inflows could fall from 72% in 2024 to 53% in 2025, hinting at a gradual shift in global capital flows.

In short, retail investors are back in action, but this time they’re spreading their money across a wider range of sectors and funds.

Be First to Comment