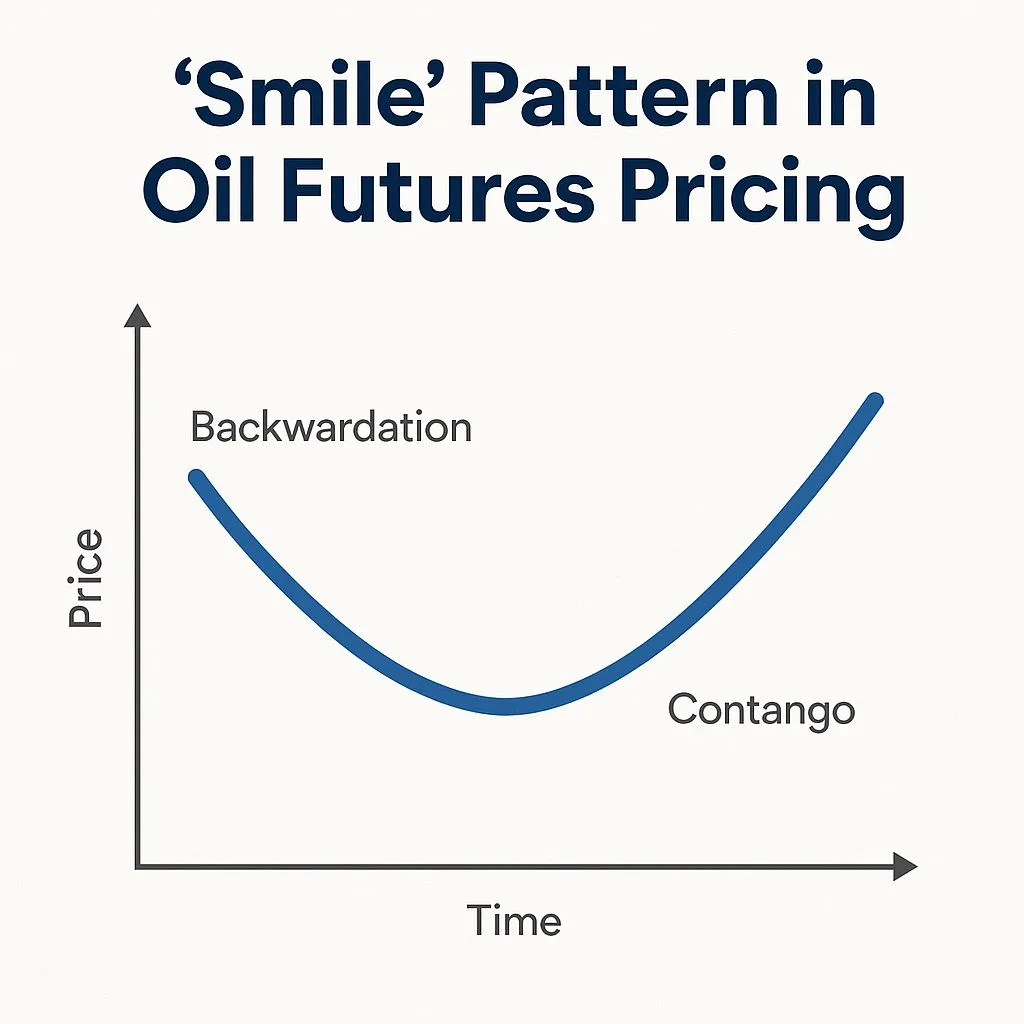

Morgan Stanley analysts have spotted an unusual trend in the Brent oil futures market. They are calling it a ‘smile’ pattern because of how the futures curve looks — prices are high in the near-term, then dip lower later, before slightly rising again.

What is this ‘Smile’ Pattern?

Normally, oil prices either move up (contango) or down (backwardation) over time.

Backwardation means oil for delivery now is more expensive than oil for delivery later — usually a sign of tight supply today.

Contango means future prices are higher — signaling more supply or weaker demand later.

But right now, Brent futures show backwardation for the first nine contracts (tightness now) and then contango after that (expected surplus later). This unusual shape — high, then low, then a slight rise — looks like a smile, which is rare in oil markets.ply or weaker demand later.

What Morgan Stanley Says

Near-term: There is a shortage of oil, keeping prices higher for immediate delivery.

Later in 2025-26: Oil supply could rise or demand could fall, making oil cheaper.

Brent Price Outlook

Brent crude was last seen trading at $65.03 for June delivery.

July futures were priced about $1 lower.

Morgan Stanley expects Brent prices could fall to the low $60s per barrel later this year.

Why It Matters

This rare ‘smile’ curve suggests that even though the market looks tight now, buyers and sellers are preparing for a softer market ahead. Traders and companies might adjust their strategies accordingly — locking in prices now while preparing for cheaper oil later.

Be First to Comment