Goldman Sachs strategist Rich Privorotsky shares his views on the current equity market outlook, highlighting both optimistic and cautious perspectives.

Here’s a straightforward summary of his bull and bear cases for the market:

The Bull Case: Summer Rally and AI Tech GrowthPrivorotsky believes the market is currently in a bullish phase driven by seasonal and structural factors:

It’s summer — Historically, markets tend to perform well during this period.

Recession fears have eased — Investors are less worried about an economic downturn for now.

Beta chase and “get nets up” mode — In May, many investors actively bought riskier stocks, pushing prices higher.

Market stability signals:

Lower volatility (vol compression)

No major external shocks

A falling US dollar supporting markets

Bonds remaining range-bound (stable yields)

Trade tensions are mostly rhetoric — Trade talk noise is present but hasn’t translated into harmful actions.

A key growth driver: AI and technology — Privorotsky compares the current period to 1997 when tech growth took off exponentially. He points to examples like Waymo dominating the driverless car service scene in San Francisco as a sign of rapid AI innovation driving market optimism.

The Bear Case: Risks and Potential Earnings Cuts AheadOn the cautious side, Privorotsky highlights several concerns that could challenge the recent rally:

Discretionary investors are re-entering risk, but cautiously — Signs that enthusiasm may be slowing down.

European markets have run up a lot — This includes strong currency moves (FX), which may not be sustainable.

Earnings cuts expected, especially in Europe — For example, GXI GY recently lowered its guidance for 2025 due to weak demand in the cosmetics sector.

Uncertainty about early Q2 performance — Front loading of earnings or activity in Q1 might mean Q2 results could look different and more mixed.

Trade deal optimism might be overdone — Markets may be overestimating the benefits of China-UK trade talks, with tougher negotiations ahead.

Short-term technical demand may be fading — Outside of volatility-driven moves, buying interest looks exhausted.

May Market Activity: Uneven Buying

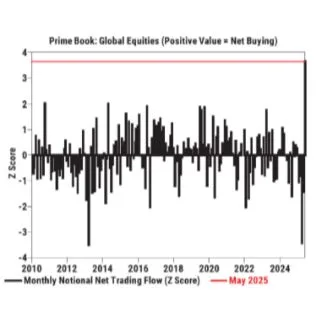

Privorotsky notes that May saw the highest monthly net buying on record, indicating positive sentiment. However, most of this buying was concentrated in just a few days:

The top 4 buying days accounted for 81% of the total net buying in May.

This suggests an uneven pace of buying, which could indicate a “stop-in” — a pause or consolidation after a sharp rally.

Summary: A Balanced View on Market DirectionWhile the market currently shows strong momentum with favorable seasonal trends and AI-led tech optimism, risks remain. Earnings uncertainty, stretched European markets, and technical demand exhaustion call for caution. Investors should watch carefully how the market navigates these opposing forces in the coming weeks.

One Comment