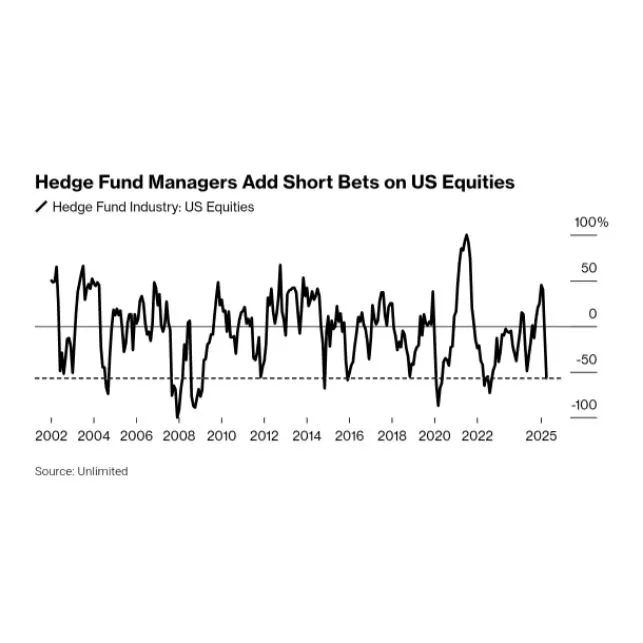

Many hedge fund managers are still playing it safe as markets swing due to global headlines and economic policies. While they are not making big moves across different investments like currencies, bonds, or commodities, they are becoming more confident about one thing — betting against US stocks.

According to Bob Elliott, head of Unlimited, hedge funds have recently increased their short positions in US stocks. Shorting means they are expecting stock prices to fall. His firm tracks data from around 3,000 hedge funds that manage nearly $5 trillion in total.

In fact, hedge funds’ short bets on US stocks have reached the highest level since the 2022 market downturn. Only a few times in the past two decades — like during the 2008 financial crisis and the 2020 pandemic — have hedge funds shown this level of bearishness. This shows a strong lack of trust in the US stock market’s future performance.

Big investors are especially negative on smaller companies in the US. Small-cap and mid-cap stocks have seen the most bearish positions. Meanwhile, some fund managers are shifting their focus to other regions like Europe and Japan, where they see better opportunities.

Overall, hedge funds seem to be more concerned about real economic issues and government policies than daily political talk or media noise. With signs of a slowing economy, many believe this is a bigger concern than any short-term news headlines.

Be First to Comment