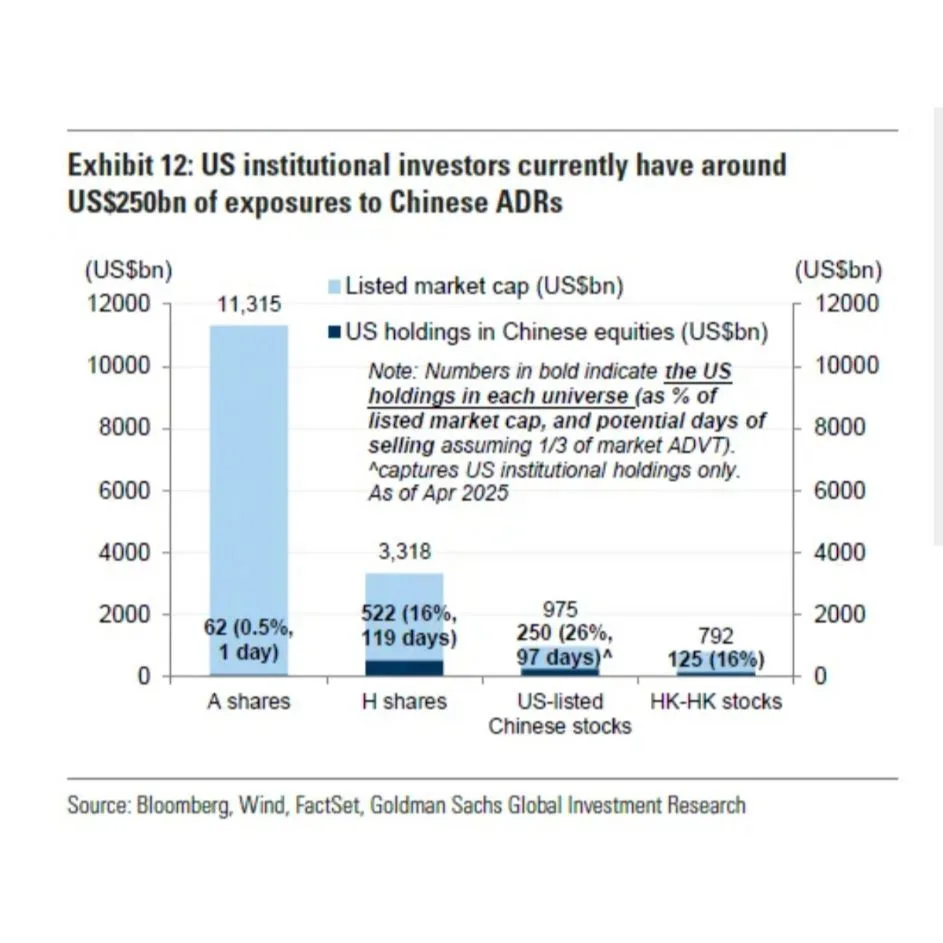

Goldman Sachs has raised concerns that U.S. investors could be compelled to dump nearly $800 billion worth of Chinese equities if financial ties between the U.S. and China break down completely. This estimate highlights the potential fallout of a severe decoupling scenario, where regulatory and political tensions force American institutions to unwind their positions in Chinese companies listed abroad.

Currently, U.S. investors hold about 7% of the market cap of Chinese firms via American Depositary Receipts (ADRs). These ADRs allow U.S. investors to invest in Chinese firms like Alibaba without trading directly on Asian exchanges. However, Goldman’s analysts noted that many of these investors may lack access to Hong Kong markets. If Chinese companies are involuntarily delisted from U.S. exchanges, institutional investors who can’t trade in Hong Kong would be left with no practical way to retain or reallocate their stakes, forcing large-scale selloffs.

This scenario would not only impact U.S. portfolios but could also trigger sharp volatility in global markets, especially in sectors heavily exposed to China.

Be First to Comment