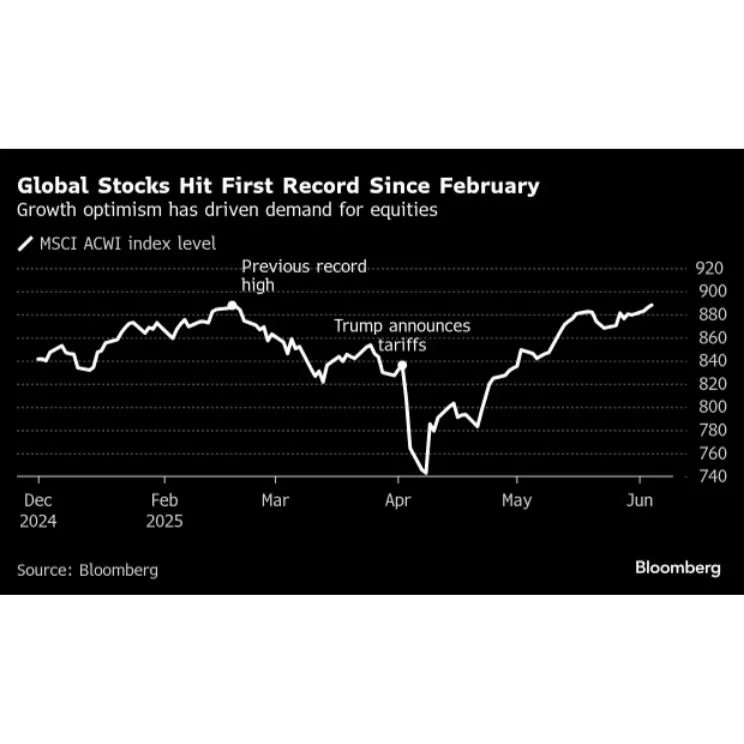

Global stock markets reached a new record for the first time since February, lifted by signs of a strong U.S. economy and growing investor confidence worldwide. The MSCI All-Country World Index, which tracks equities across 47 nations, rose 0.3% to 888.24—surpassing its previous high of 887.72 set earlier this year.

Markets have staged a strong rebound since April, helped by a more cautious approach to trade tariffs from U.S. President Donald Trump. Solid corporate earnings in both the U.S. and Europe, along with healthy U.S. jobs data, have eased recession worries and restored optimism.

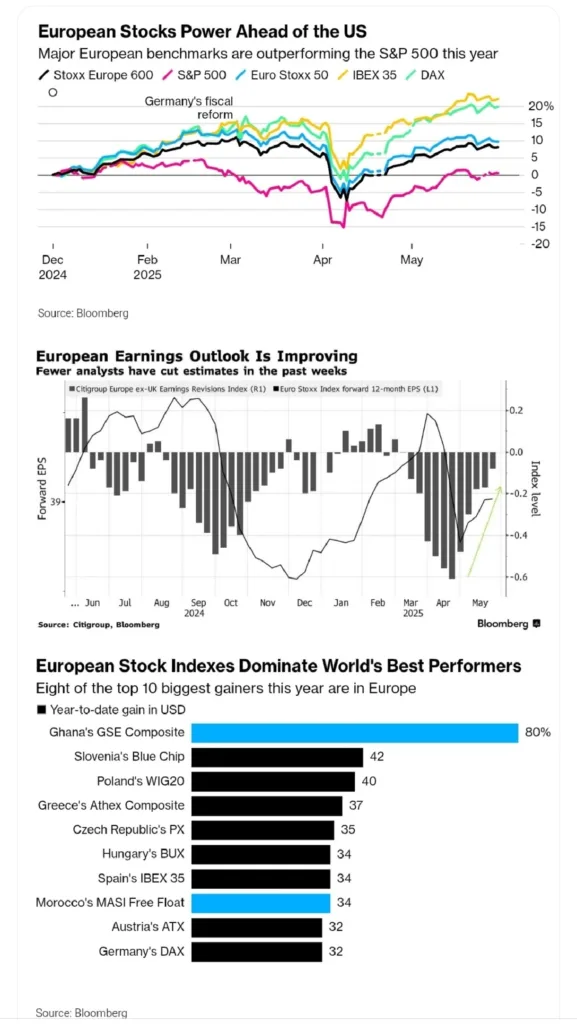

While the U.S. remains a pillar of global market strength, Europe is clearly leading the charge in 2025. Eight of the world’s top 10 best-performing stock markets this year are in Europe, with Slovenia, Germany, and Poland topping the list. Analysts forecast that up to $1.4 trillion could flow into European equities as central banks prepare for interest rate cuts and investors seek out cheaper valuations.

Germany’s DAX has continued to gain ahead of a planned €46 billion ($52 billion) package of corporate tax cuts. The Stoxx Europe 600 index has already outpaced the S&P 500 by a record 18 percentage points this year in dollar terms, drawing in global capital as U.S. stocks appear increasingly expensive by comparison.

With strong earnings, favorable monetary policy shifts, and relatively low stock prices in Europe, global investors are repositioning—and it’s giving both the U.S. and European markets renewed momentum.

One Comment