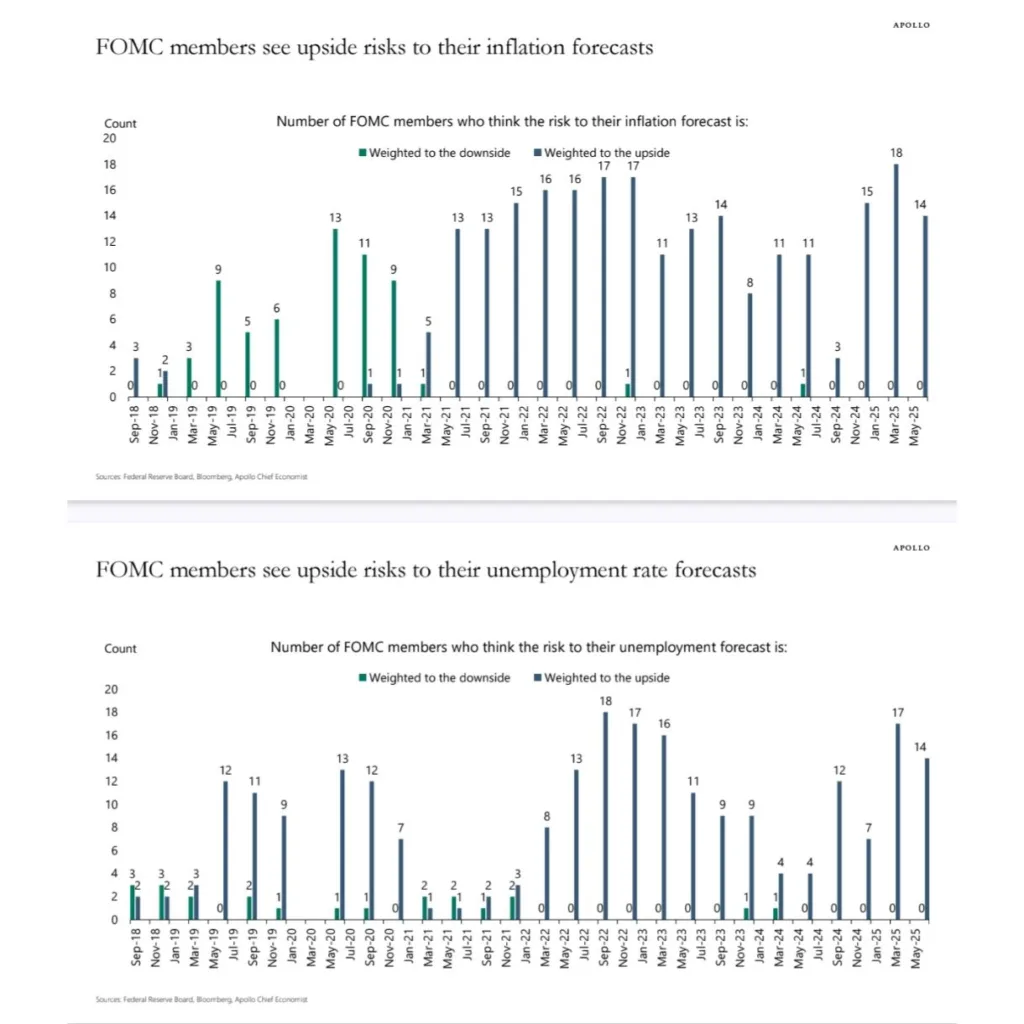

The Federal Reserve’s FOMC members regularly share their forecasts for inflation and unemployment before each meeting. They also note whether they see risks that inflation or unemployment could go higher or lower than expected.

Key takeaway from the latest update:

No FOMC member sees a risk of inflation or unemployment falling.

All concerns are about inflation and unemployment rising.

This combination — rising prices and rising joblessness — is called stagflation, and it’s a worrying signal for the U.S. economy.

What’s driving these concerns?

Experts believe the following factors are putting upward pressure on both inflation and unemployment:

Higher oil pricesIncreased tariffs

Tighter immigration rules

These conditions make it more expensive for businesses to operate and harder for them to find workers, leading to both higher costs and fewer jobs.

What the charts show:

In May 2025, 18 FOMC members saw upside risks to inflation, while none saw downside risks.

In the same month, 17 members saw upside risks to unemployment, and again, none saw downside risks.

This shift in sentiment shows that Fed officials are becoming more concerned about a weakening economy with persistent inflation — a tough situation for policymakers.

Summary:

The Fed is increasingly worried that the U.S. might face stagflation — a rare and difficult mix of rising prices and rising unemployment.

Source: Federal Reserve Board, Bloomberg, Apollo Chief Economist

Be First to Comment