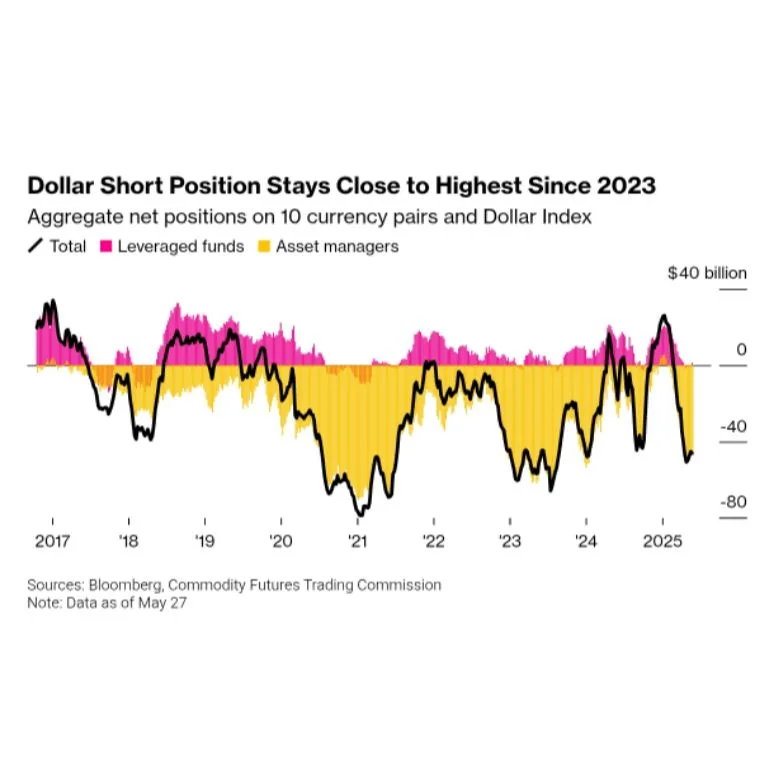

Institutional investors are turning increasingly negative on the US Dollar. According to recent data, asset managers now hold net short positions worth $47 billion against the dollar — near the highest levels since December 2023. Short bets have doubled in just two months, as the US Dollar Index (DXY) has fallen sharply.

So far in 2025, the US Dollar Index is down 9.5% year-to-date, marking its worst start to a year in three decades.

Global Currencies Gain

As the dollar weakens, rival currencies are gaining strength:

Euro: +10.1%

Swiss Franc: +10.3%

Japanese Yen: +8.5%

This shift is driven partly by growing global trade tensions and increased tariffs under the Trump-led trade agenda, which have hurt sentiment toward US assets.

What’s Next for the Dollar?

Analysts at Morgan Stanley predict that the Dollar Index could fall another 9% to around 91 by mid-2026. They also expect:

Euro to rise to 1.25 (from ~1.13 now)

Pound to reach 1.45 (up from 1.35)

Yen to strengthen to 130 per dollar (from 143)

The dollar’s slide is boosting other currencies seen as safe havens, such as the euro, yen, and franc.

What About US Bond Yields?

Morgan Stanley also forecasts that US 10-year Treasury yields will hit 4% by end of 2025, and could fall further in 2026 as the Federal Reserve cuts rates by up to 175 basis points.

This rate cut outlook is another factor pushing the dollar lower.

Be First to Comment