Understanding Bear Market Rallies

Bear markets are difficult periods for investors, but even during these tough times, there can be short bursts of optimism called “bear market rallies.” These rallies are temporary recoveries where stock prices rise for a while before falling again to new lows.

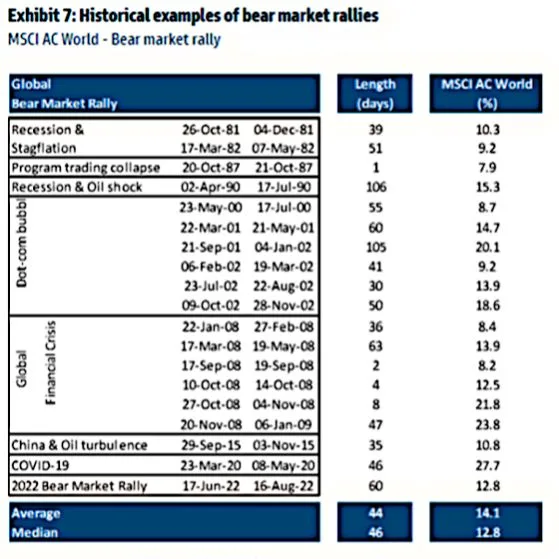

Historical data from the MSCI AC World Index shows that bear market rallies have some common patterns. On average, a bear market rally lasts about 44 days and delivers a 14.1% return. The median rally duration is slightly longer at 46 days, with a median return of 12.8%.

Looking at the past, we can see several examples:

After the recession and stagflation in the early 1980s, there were short rallies of about 39–51 days with gains around 9–10%.

During the Dot-com bubble burst (2000–2002), there were multiple rallies. Some lasted over 100 days, with returns as high as 20.1%.

The Global Financial Crisis (2008–2009) also had several rallies, with gains between 6.8% and 19.2%, lasting anywhere from a few days to over two months.

More recently, during the COVID-19 pandemic, there was a strong bear market rally where the market jumped 27.7% in just 46 days.

Even in 2022, during a tough global environment, there was a bear market rally that lasted 60 days and saw the MSCI AC World Index gain 12.9%.

However, despite these short-term gains, the broader market usually continues to struggle after these rallies, eventually making new lows. This is why many experts caution against assuming that every market bounce means the bear market is over.

In summary, while rallies can bring hope and temporary gains, historical trends suggest caution. Whether the current market move is just another bear market rally or the start of a true recovery will only be clear with time.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment