RBI Increases ATM Interchange Fees – Higher Withdrawal Charges from May

Starting May 1, ATM cash withdrawals in India will become more expensive as the Reserve Bank of India (RBI) has approved an increase in ATM interchange fees. This means that customers who exceed their free transaction limit will have to pay higher charges for both financial and non-financial transactions at ATMs.

What Is ATM Interchange Fee?

The ATM interchange fee is the amount one bank pays to another for allowing its customers to use their ATMs. This fee covers the cost of ATM maintenance, security, and cash replenishment. Banks often pass on this cost to customers in the form of transaction charges once they exceed their free usage limit.

Why Are ATM Charges Increasing?

The decision to raise ATM charges comes after requests from white-label ATM operators. These operators argued that rising operational costs were impacting their business, making it necessary to revise ATM fees.

As digital transactions continue to grow, ATM usage has declined, but many customers still prefer cash withdrawals over digital payments. The fee hike is expected to impact smaller banks’ customers more, as they depend on larger banks for ATM infrastructure and services.

New ATM Withdrawal and Transaction Charges from May 1

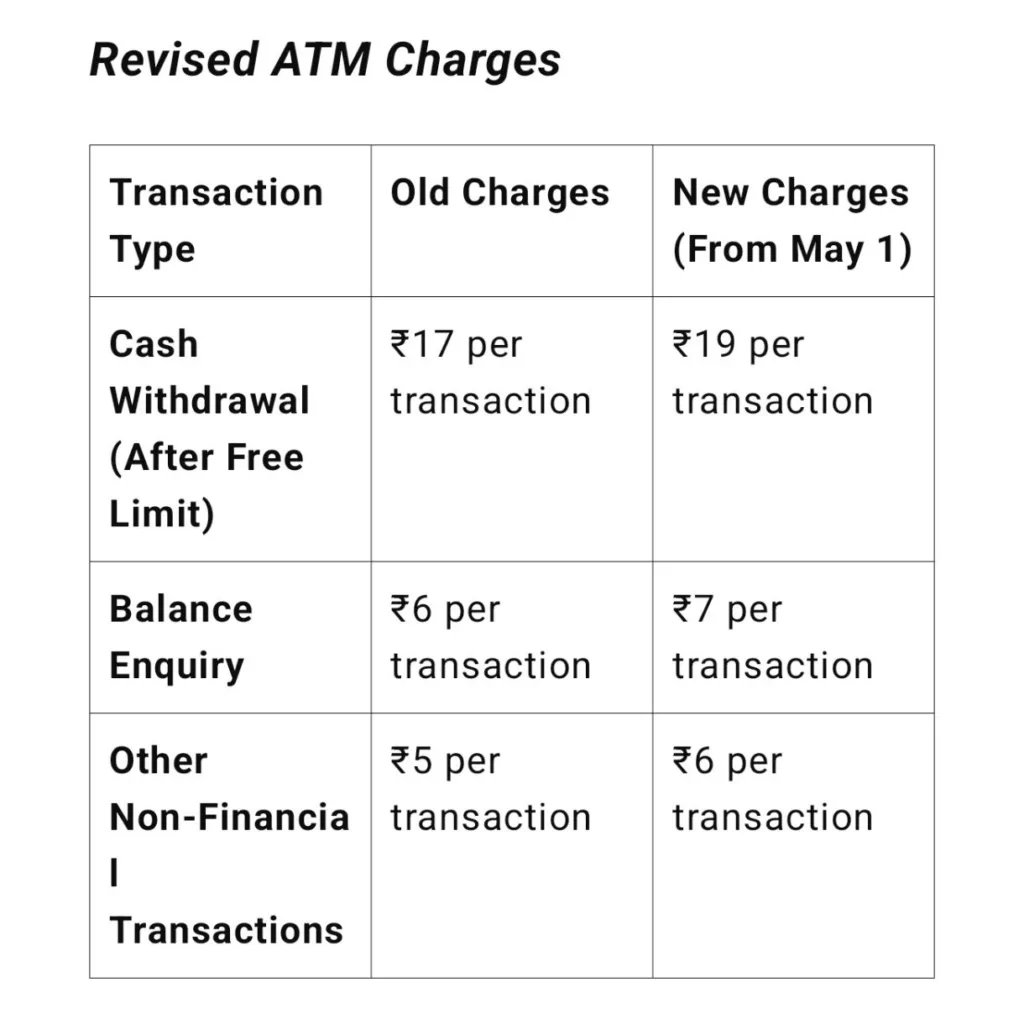

RBI has announced an increase in ATM withdrawal and non-financial transaction fees. Here’s what will change:

Revised ATM Charges

These charges will apply only after customers exceed their monthly free transaction limit, which varies based on their bank and type of account.

Who Will Be Affected the Most?

• Customers who frequently withdraw cash beyond their free limits

• Account holders of smaller banks that rely on bigger banks’ ATMs

• Those who prefer cash over digital payments

Why This Matters?

ATMs were once considered a revolutionary banking service, making cash access easy and convenient. However, with the rise of UPI, mobile wallets, and online banking, ATM usage has seen a decline. Despite this, cash transactions remain crucial, especially in rural areas and small businesses.

As ATM maintenance costs increase, banks and operators are passing these costs onto consumers. While the fee hike may encourage more digital transactions, it also raises concerns about accessibility for people who depend on cash withdrawals.

SBI Profits from ATM Withdrawals While Other PSBs Face Losses: Govt Report

The Indian government has revealed that while the State Bank of India (SBI) is making a substantial profit from ATM cash withdrawal fees, most other public sector banks (PSBs) are facing financial losses in this area. Over the last five years, SBI earned Rs 2,043 crore from ATM withdrawals, whereas nine PSBs collectively lost Rs 3,738.78 crore. Among these banks, only Punjab National Bank (PNB) and Canara Bank managed to make a profit, earning Rs 90.33 crore and Rs 31.42 crore, respectively.

As per the government’s statement in the Lok Sabha, SBI has consistently generated high revenue from ATM fees, while other PSBs have struggled with losses.

Final Thoughts

If you frequently withdraw cash, it’s advisable to track your free transaction limit and use digital payments wherever possible to avoid extra charges. With these new changes, ATM withdrawals will become costlier, pushing more people toward digital banking solutions.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment